Photo AI

Last Updated Sep 24, 2025

Working Capital Management Simplified Revision Notes for SSCE HSC Business Studies

Revision notes with simplified explanations to understand Working Capital Management quickly and effectively.

395+ students studying

Working Capital Management

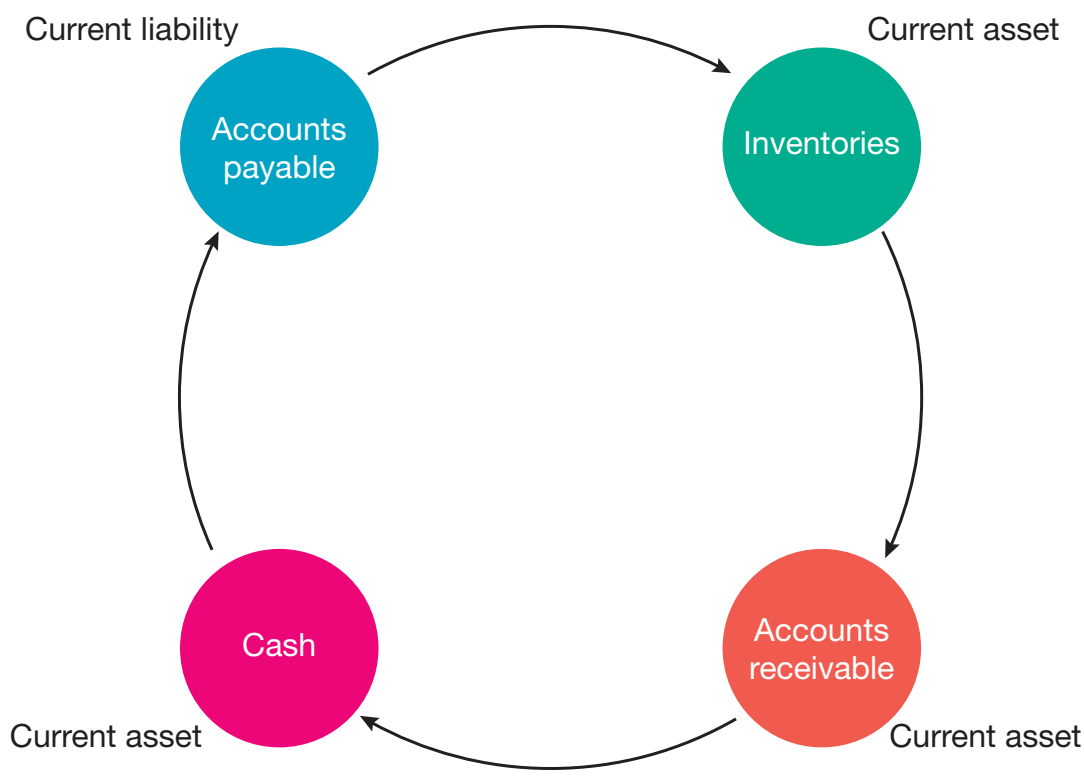

Working capital management involves the strategies and procedures that a business employs to efficiently control its short-term assets and liabilities. It is crucial for managing cash flow, inventories, receivables, and payables, thereby ensuring operational efficiency and financial stability.

Key Concepts

Working Capital:

Working Capital: The funds a company utilises to manage its daily operations.

-

Importance:

- Provides business stability by covering short-term debts and operational costs.

- Facilitates smooth day-to-day operations.

- Supports supplier relationships and boosts investment potential.

-

Formula:

infoNoteA positive working capital indicates liquidity and operational stability, whereas a negative value may signal financial challenges.

-

Components include:

- Current Assets: Cash, inventory, accounts receivable.

- Current Liabilities: Accounts payable, short-term debt.

Definition Callout

- Working Capital: Resources used by a company for its daily operations.

- Cash Management: Oversight of cash flow to ensure liquidity and stability.

- Liquidity: The ability to meet short-term financial obligations.

- Receivables: Amounts owed by customers, vital for maintaining cash flow.

- Inventory: Items available for sale or for use in production.

- Payables: Short-term obligations to suppliers.

- Loan: A fixed-term borrowing arrangement.

- Overdraft: A revolving credit facility.

- Lease: Renting assets to avoid ownership costs.

Cash Management

Cash Management entails overseeing a company's cash flow to maintain liquidity and operational stability.

-

Key Techniques:

-

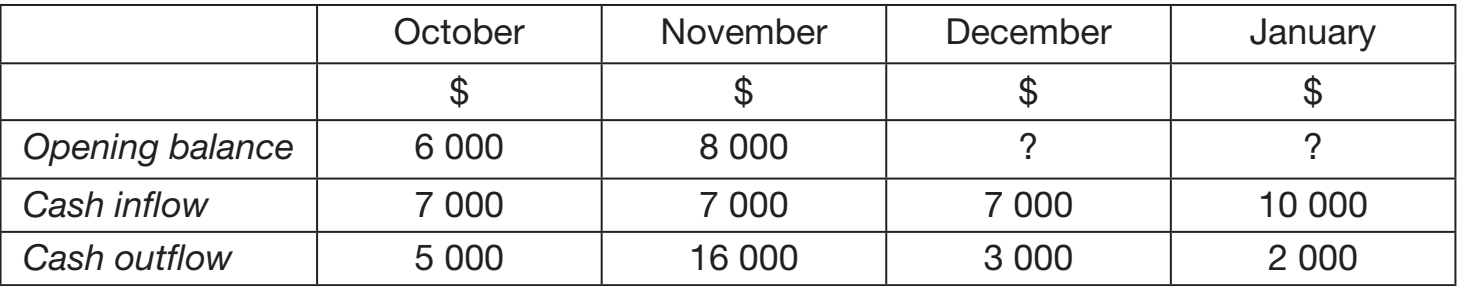

Cash Flow Forecasting:

- Predict cumulative cash surpluses and deficits.

- Assess inflows and outflows, adjusting for upcoming events.

infoNoteKey Forecast Elements:

- Revenue: Projected income from sales.

- Expenses: Expected business costs.

- Investment Activities: Planned asset purchases.

-

-

Cash Reserves and Overdrafts:

- Cash reserves serve as a financial buffer.

- Overdrafts can provide emergency cash flow solutions.

chatImportantWhile useful, overdrafts can become costly if not managed properly.

Receivables Management

Effective Receivables Management is vital to prevent cash flow issues.

-

Key Strategies:

- Offer early payment discounts to encourage timely customer payments.

- Implement strict credit policies to mitigate default risks.

- Use aged debtor reports for ongoing monitoring, categorising overdue payments by age to streamline collections.

infoNoteEfficient receivables management is essential to sustain financial stability.

-

Enhanced Payment Experience via:

- Diverse payment options, such as online gateways and direct debits.

Inventory Management

Inventory:

Inventory involves:

-

Raw Materials: Items used in the production process.

-

Work-in-Progress: Products that are partially completed.

-

Finished Goods: Items ready for sale.

-

Techniques:

- Just-In-Time (JIT) minimises waste and holding costs.

- Economic Order Quantity (EOQ) balances ordering with holding costs.

- ABC Analysis prioritises inventory based on item value.

-

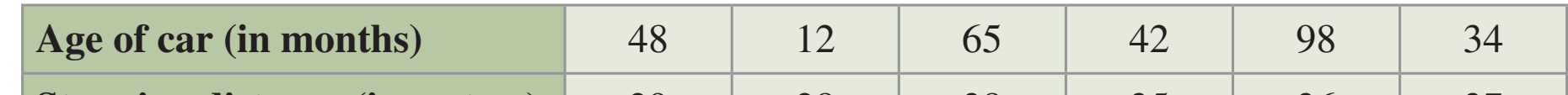

Turnover Ratio: Evaluates how often inventory is sold and replaced:

Payables Management

Payables entail a company's short-term debts to suppliers and creditors.

-

Strategies for Effectiveness:

- Negotiate improved payment terms to boost cash flow.

- Utilise automated systems to maintain precise records.

- Ensure timely payments to avoid penalties and build supplier trust.

-

Turnover Ratio:

- Evaluates the frequency of payable settlements:

Short-term Financing Options

Short-term financing is essential for preserving liquidity.

-

Loans and Overdrafts:

- Loans provide fixed terms and stability.

- Overdrafts offer flexibility, albeit often at higher costs.

-

Key Considerations:

- Evaluate interest rates and fees.

- Align financial strategies with cash flow demands.

chatImportantUnderstanding potential risks associated with short-term financing is crucial for financial health.

Leasing

Leasing lets businesses obtain necessary assets without immediate capital expenditure.

-

Benefits:

- Enhances cash flow management by spreading costs over time.

- Offers flexibility for asset upgrades.

- Provides tax benefits by reducing taxable income.

-

Strategic Evaluation is necessary to ensure leasing aligns with business requirements.

Sale and Leaseback

Sale and Leaseback:

In this strategy, an asset is sold and subsequently leased back to release cash.

-

Key Benefits:

- Improves liquidity.

- Maintains operational continuity absent asset ownership.

-

Considerations:

- The potential for increased costs due to leases.

-

Example: Woolworths utilised sale and leaseback to bolster liquidity, thus improving financial standing.

Mitigating Working Capital Pitfalls

-

Identify pitfalls such as slow-paying customers and work to support sustainable development.

-

Case Examples:

- Retailers offering early payment incentives decrease debtor days, enhancing cash flow.

- Maintaining the balance between growth and resources prevents overspending.

-

Regular Monitoring enables proactive strategies to uphold financial health.

Key Diagrams

To visualise, several diagrams illustrate cash management procedures, inventory methods, and receivables processes for enhanced clarity. Please refer to the diagrams highlighting the cash cycle, inventory management, and financial flowcharts within this content for further comprehension.

500K+ Students Use These Powerful Tools to Master Working Capital Management For their SSCE Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

190 flashcards

Flashcards on Working Capital Management

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards19 quizzes

Quizzes on Working Capital Management

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes146 questions

Exam questions on Working Capital Management

Boost your confidence with real exam questions.

Try Business Studies Questions13 exams created

Exam Builder on Working Capital Management

Create custom exams across topics for better practice!

Try Business Studies exam builder24 papers

Past Papers on Working Capital Management

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Working Capital Management you should explore

Discover More Revision Notes Related to Working Capital Management to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Financial management strategies

Exchange Rates and Interest

368+ studying

188KViews