Photo AI

Last Updated Sep 24, 2025

Financial Planning Processes Simplified Revision Notes for SSCE HSC Business Studies

Revision notes with simplified explanations to understand Financial Planning Processes quickly and effectively.

464+ students studying

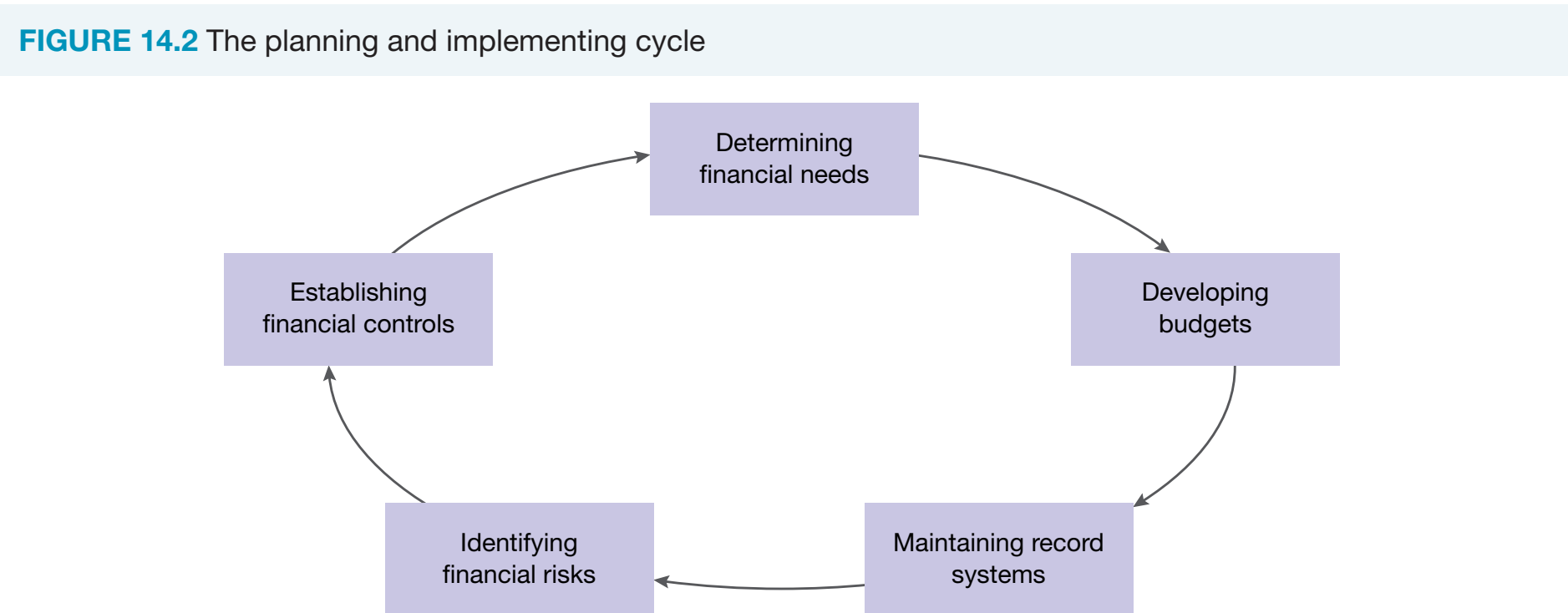

Financial Planning Processes

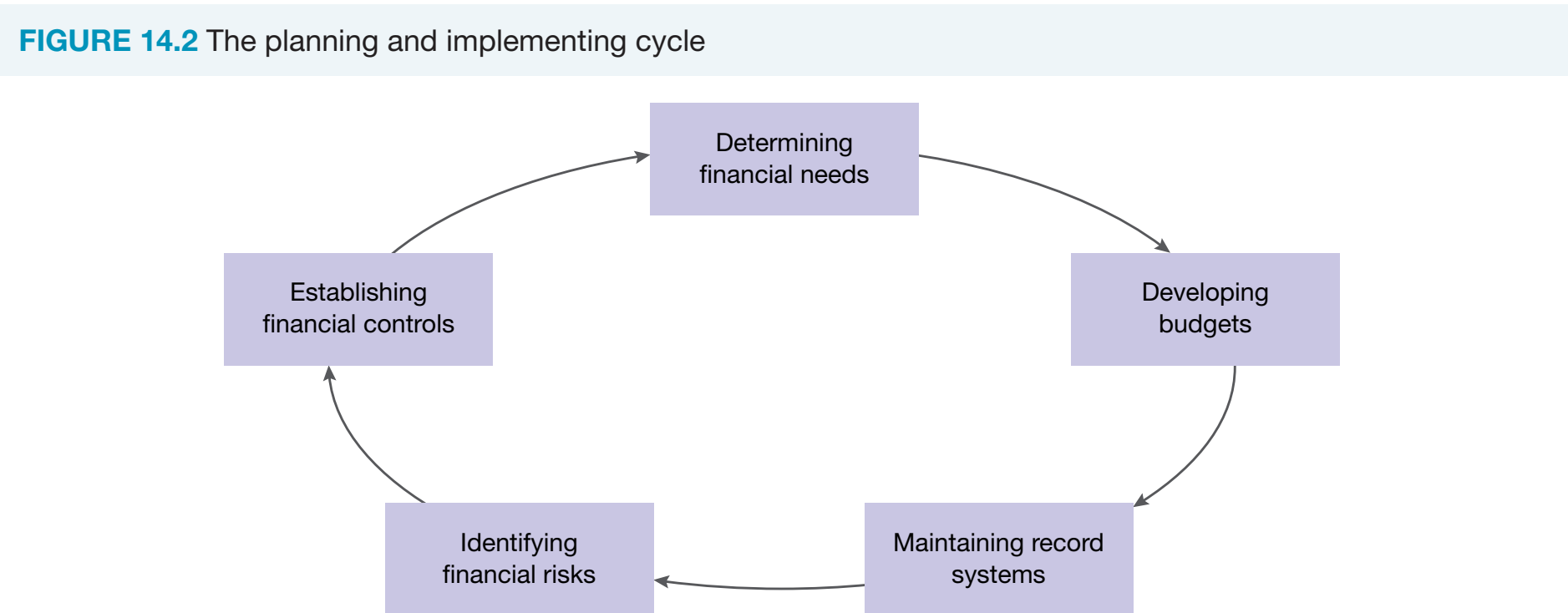

This document outlines the essential components of planning and implementing processes in financial management vital for informed business decision-making.

Introduction to Financial Needs

Financial Needs

Financial Needs: Resources required by a business to sustain operations and support growth. Strategic planning, particularly when expanding into new markets, significantly depends on the accurate identification of these needs.

-

Importance:

- Financial needs influence operations, including reaching production targets and ensuring adequate cash flow.

- Strategic importance for long-term success.

- Example: A company investing in new machinery to enhance operational efficiency.

-

Personal Finance Analogy: Planning for university expenses as a student.

Recognising financial needs is strategically important for ensuring long-term business success.

Methods for Identifying and Evaluating Financial Needs

-

Financial Statements:

- Income Statement: Displays profitability by comparing revenues to expenses.

- Cash Flow Statement: Illustrates liquidity status necessary for day-to-day operations.

- Balance Sheet: Assesses overall financial health through a snapshot of assets and liabilities.

-

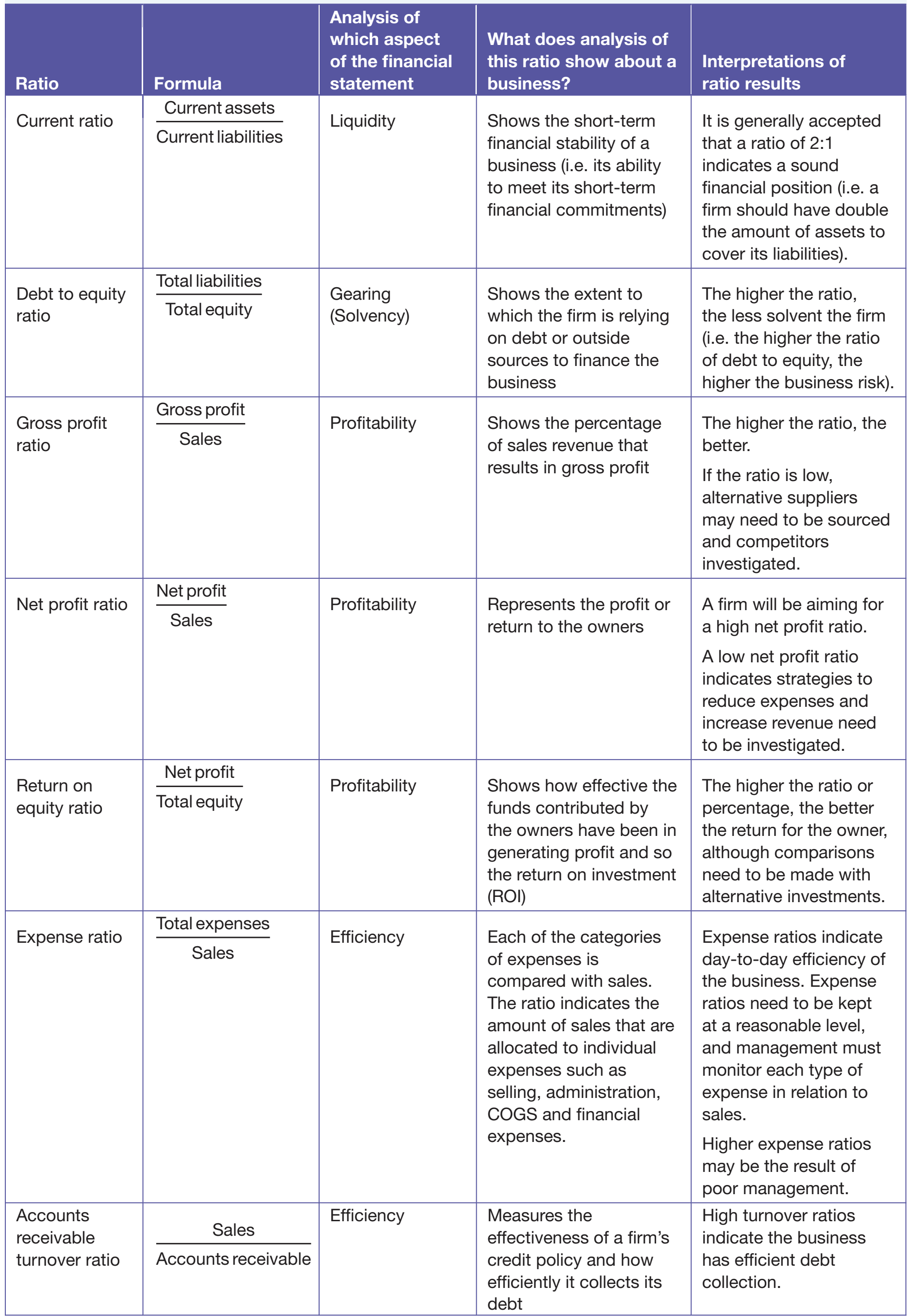

Ratio Analysis:

-

Liquidity Ratios: Evaluate short-term financial stability.

-

Profitability Ratios: Measure the efficiency in generating profit.

-

Solvency Ratios: Determine the ability to manage long-term debt.

-

Tools and Techniques

-

Cost and Revenue Estimation:

- Essential for forecasting future finances using historical and trend data.

-

Budgeting Tools:

- Platforms such as Xero for tracking accounts; useful also for student budget management.

-

Scenario Planning:

- Assists in preparing for risks like natural disasters affecting supply chains by developing contingency strategies.

Financial Forecasting and Strategic Decisions

-

Accurate Financial Forecasting:

-

Utilise historical data and trend analysis for precise forecasting.

chatImportantProficiency in financial forecasting is crucial as it supports strategic decision-making and risk management.

-

-

Example: Inaccurate forecasting can result in overproduction or stock deficits, emphasising the importance of precision in predictions.

Budget Planning and Role

Budgets

Budgets: Essential financial plans for resource allocation and cost management. They guide businesses in strategy formulation and financial planning.

The Role of Budgets

- Strategic Financial Planning and Decision-Making:

-

Budgets align resource allocation with company goals.

-

Provide benchmarks for evaluating performance in terms of revenue and expenses.

infoNoteBudgets are integral in aligning business goals and guiding strategic financial planning.

-

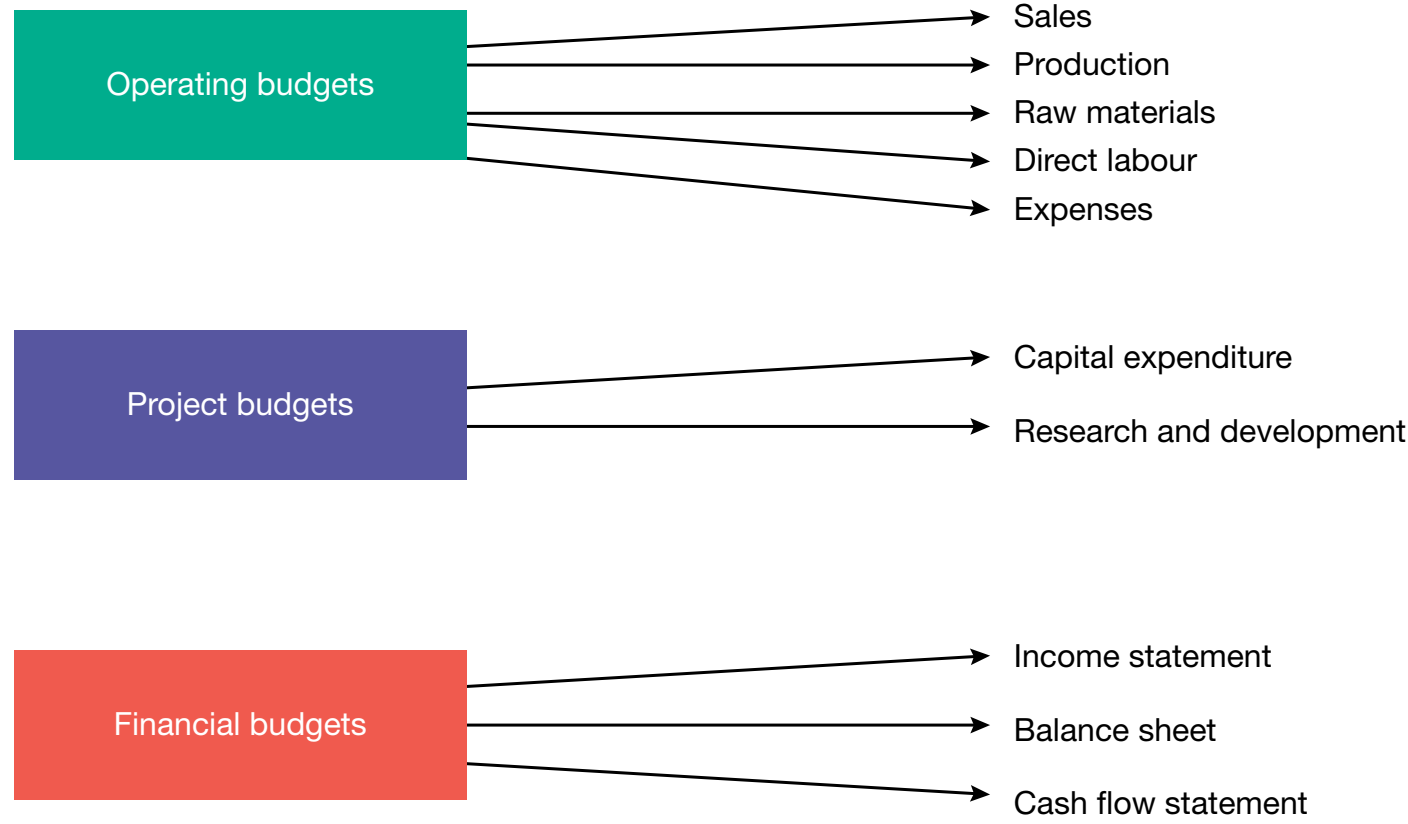

Types of Budgets

-

Operating Budgets:

-

Sales Budget: Projects revenue.

-

Production Budget: Plans production outputs.

-

Expense Budget: Anticipates operational costs.

infoNoteExamples:

- Sales Budget: Predicting revenue from a school club event.

- Production Budget: Planning events for a catering business based on projections.

-

-

Capital Expenditure Budgets: Focus on long-term investments like purchasing equipment.

Challenges in Budget Management

- Common Challenges:

-

Inaccurate forecasting can undermine planning efforts.

-

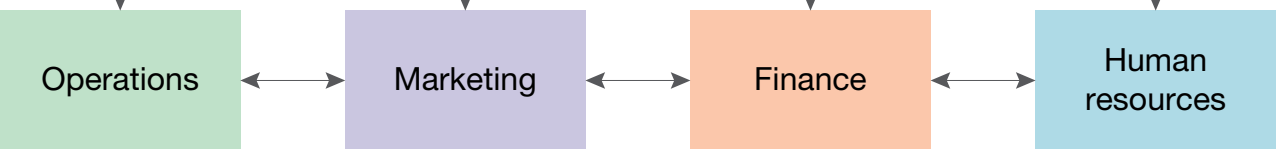

Lack of communication across departments hampers efficiency.

chatImportantMismanagement adversely affects cash flow and restricts strategic flexibility.

-

Strategies to Overcome Challenges

-

Enhanced Forecasting:

- Emphasise trend analysis leveraging past data.

-

Departmental Integration:

-

Encourage collaboration and streamline adherence.

-

-

Budget Tools:

- Utilise templates and software like QuickBooks to facilitate analysis.

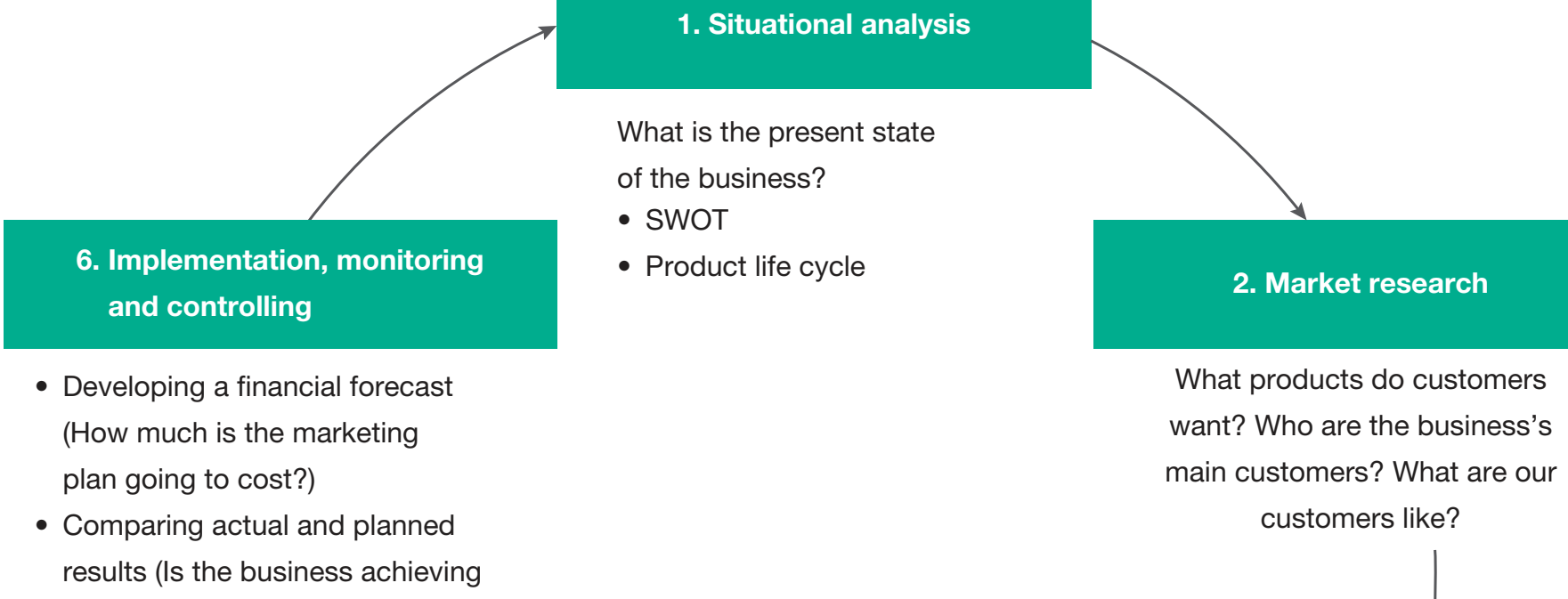

Visual Aids and Examples

-

Visual Tools: Use flowcharts to aid in understanding budgeting processes.

Financial Risk Assessment

Identify Common Financial Risks

-

Credit Risk: Potential default on obligations affecting financial choices.

- Consequences include increased borrowing costs and defaulted debts.

-

Market Risk: Losses in asset value due to market fluctuations.

- Causes volatility in asset prices, necessitating adaptive strategies.

-

Liquidity Risk: Challenges in meeting short-term financial commitments.

-

Operational Risk: Issues arising from process failures.

infoNoteIdentifying these risks is key to maintaining long-term financial stability.

Strategies and Tools for Risk Management

-

Cash Flow Management: Ensures liquidity to meet immediate obligations.

-

Diversification and Derivatives:

- Reduces total risk.

- Hedging utilising options and futures.

-

Risk Assessment Tools:

-

Employ SWOT analysis and risk matrices.

chatImportant

chatImportantActive cash flow management is crucial for stabilising operations by mitigating multiple risks.

-

Introduction to Record Systems

Records Systems

Records Systems: Essential tools for ensuring financial transparency and aiding strategic decisions.

-

Compare manual versus electronic systems.

-

Guarantee accuracy and support regulatory compliance.

infoNoteSystems are vital for maintaining transparency, supporting decisions, and preventing errors.

Choosing the Right Record System

- Considerations:

-

Consider the scale of the business, transaction complexity, and growth capacity.

infoNote

infoNoteOpt for electronic systems in environments requiring real-time data.

-

Introduction to Financial Controls

Financial Controls: Mechanisms guaranteeing financial integrity and mitigating fraud.

- Significance:

-

Mitigate risks and counteract fraud.

-

Ensure operational efficiency and regulatory compliance.

chatImportantAddressing risks and thwarting fraud is fundamental for business success.

-

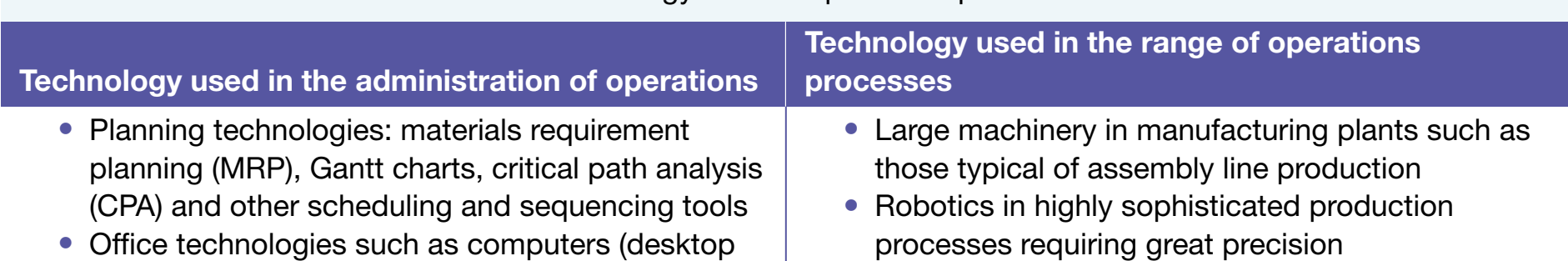

Control Measures and Technology Role

-

Authorisation and Cash Control:

-

Establish tiered approval processes for significant purchases.

-

Implement secure cash handling protocols.

-

-

Technology Enhancements:

-

Utilise accounting software for process automation.

-

Deploy security systems for data protection.

infoNote

infoNoteStress the importance of ongoing training and technological adaptation.

-

Conclusion

Implementing effective financial management processes is vital for business stability and growth. Regular reassessment allows adaptation to evolving market conditions.

500K+ Students Use These Powerful Tools to Master Financial Planning Processes For their SSCE Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

210 flashcards

Flashcards on Financial Planning Processes

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards30 quizzes

Quizzes on Financial Planning Processes

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes105 questions

Exam questions on Financial Planning Processes

Boost your confidence with real exam questions.

Try Business Studies Questions4 exams created

Exam Builder on Financial Planning Processes

Create custom exams across topics for better practice!

Try Business Studies exam builder24 papers

Past Papers on Financial Planning Processes

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Financial Planning Processes you should explore

Discover More Revision Notes Related to Financial Planning Processes to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Processes of financial management

Debt and Equity Financing

300+ studying

195KViews