Photo AI

Last Updated Sep 24, 2025

Financial Management Interdependence Simplified Revision Notes for SSCE HSC Business Studies

Revision notes with simplified explanations to understand Financial Management Interdependence quickly and effectively.

463+ students studying

Financial Management Interdependence

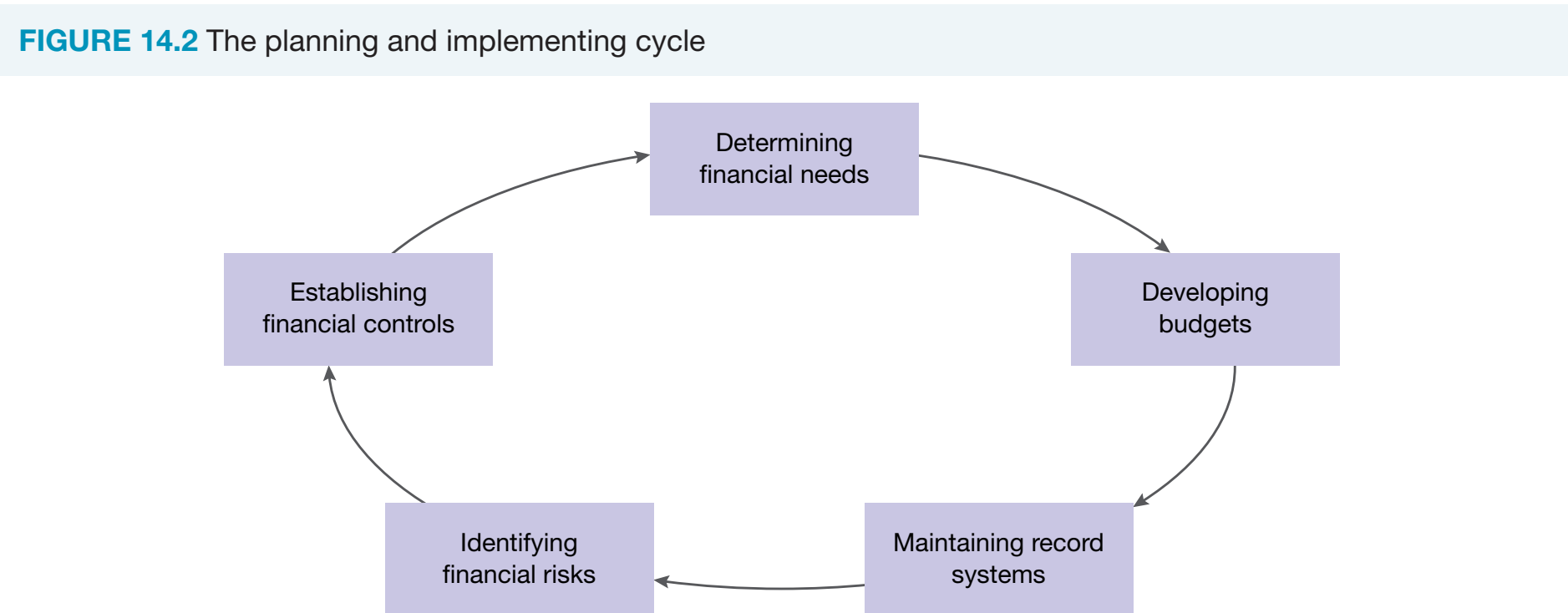

Overview of Financial Management

Introduction to Financial Management

Financial Management: The process of strategic planning, organising, directing, and controlling financial activities within an organisation.

- Primary Roles:

- Allocate financial resources effectively.

- Monitor and enhance resource utilisation.

- Maximise stakeholder wealth.

Objectives of Financial Management:

-

Profitability: Ensures a business remains profitable through stringent cost control and efficient revenue management.

- ROI Example: Return on Investment (ROI) is calculated as .

-

Growth: Supports expansion through strategic planning, resource allocation, and innovation.

-

Efficiency: Attains optimal resource utilisation, focusing on reducing waste and enhancing productivity.

-

Liquidity and Solvency: Maintains liquidity for daily operations and ensures solvency for long-term financial well-being.

- Example: Managing cash flow to meet immediate financial commitments.

Definitions:

- Profitability: Generating more income than expenses.

- Growth: Strategic increase in market reach or capacity.

- Efficiency: Effective use of resources to maximise output.

- Liquidity: Ease of accessing cash or liquid assets.

- Solvency: Ability to meet long-term liabilities.

Balancing Short-term and Long-term Financial Goals

-

Understanding the Balance:

- Short-term Goals: Focus on immediate financial needs and maintaining liquidity.

- Long-term Goals: Prioritise strategic aspects like growth and solvency.

-

Industry Examples:

- Tech Industry: Google invests in R&D, affecting short-term cash flow but promoting long-term growth.

- Retail Sector: Tesco expands store networks, impacting liquidity but increasing market presence.

Key Aspects of Financial Decision-Making

-

Asset Management: Involves acquiring and managing assets to maximise returns.

- Example: Assess machinery depreciation using the declining balance method.

-

Risk Assessment: Identifies and evaluates financial risks to avert losses.

- Example: Employ financial modelling to anticipate potential market fluctuations.

-

Financial Reporting: Ensures transparency and accuracy in business financials.

Data-informed decision-making is essential for maintaining a robust financial strategy.

Aligning Financial Strategies with Business Goals

-

Strategic Alignment: Aligns financial strategies with the company's mission and vision.

-

Iterative Reviews: Regular reviews ensure financial strategies remain aligned with business goals and market changes.

- Example: Bi-annual strategy meetings refine financial approaches.

Introduction to Financial Objectives

Financial Objectives: Guidelines directing business activities.

- Profitability: Capability to generate profits.

- Growth: Increase in sales or assets.

- Efficiency: Resource optimisation.

- Liquidity: Management of short-term obligations.

- Solvency: Management of long-term debt.

Detailed Explanation of Each Objective

Profitability:

- Definition: Vital for growth and shareholder satisfaction.

- Example: A company with £100,000 monthly revenue reduces expenses by 10%, enhancing profit margins.

Profitability is a crucial performance indicator.

Growth:

- Definition: Increase in sales or assets.

- Types: Organic (internal growth) vs. Inorganic (mergers/acquisitions).

Efficiency:

- Definition: Maximising output with optimised resource use.

- Example: Automation raises production rates from 500 to 600 units/hour.

Liquidity:

- Definition: Management of short-term financial obligations.

Liquidity management is critical for smooth operations.

Solvency:

- Definition: Ability to meet long-term liabilities.

- Example: Debt-equity ratio assessments: A ratio of 0.5 is considered healthy.

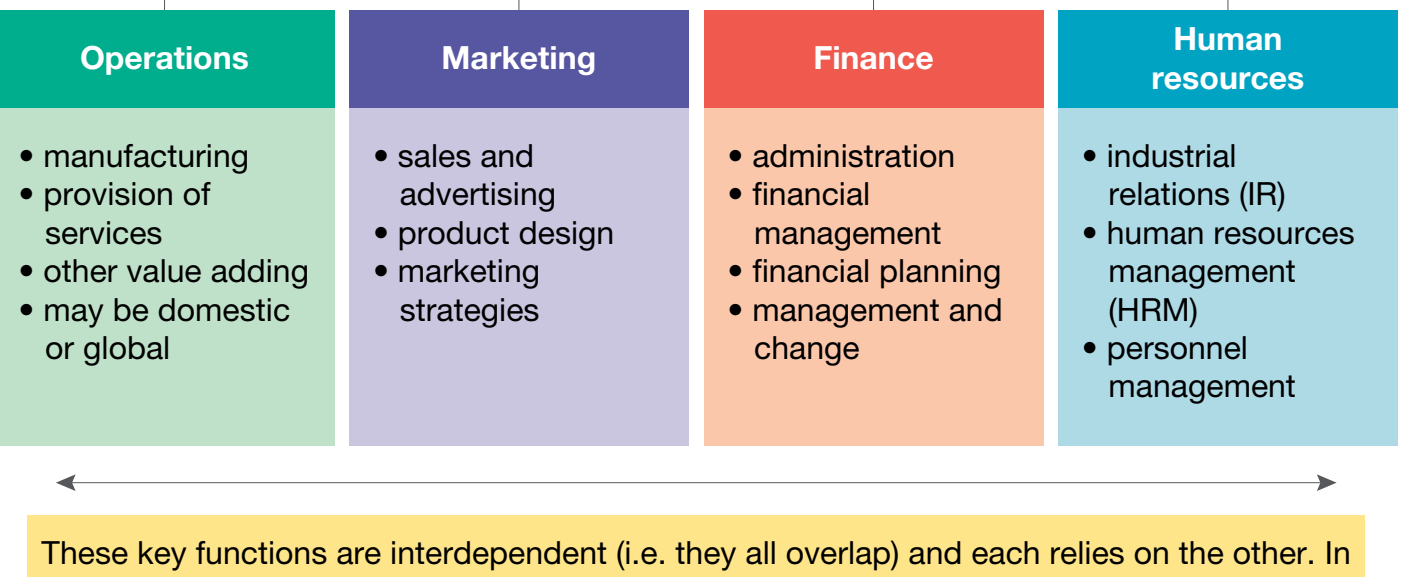

Interdependence with Other Key Business Functions

Introduction to Interdependence

Interdependence between Business Functions: Strategic coordination of financial management with other departments enhances operations.

Theoretical Importance: Collaboration optimises resource allocation and supports strategic objectives.

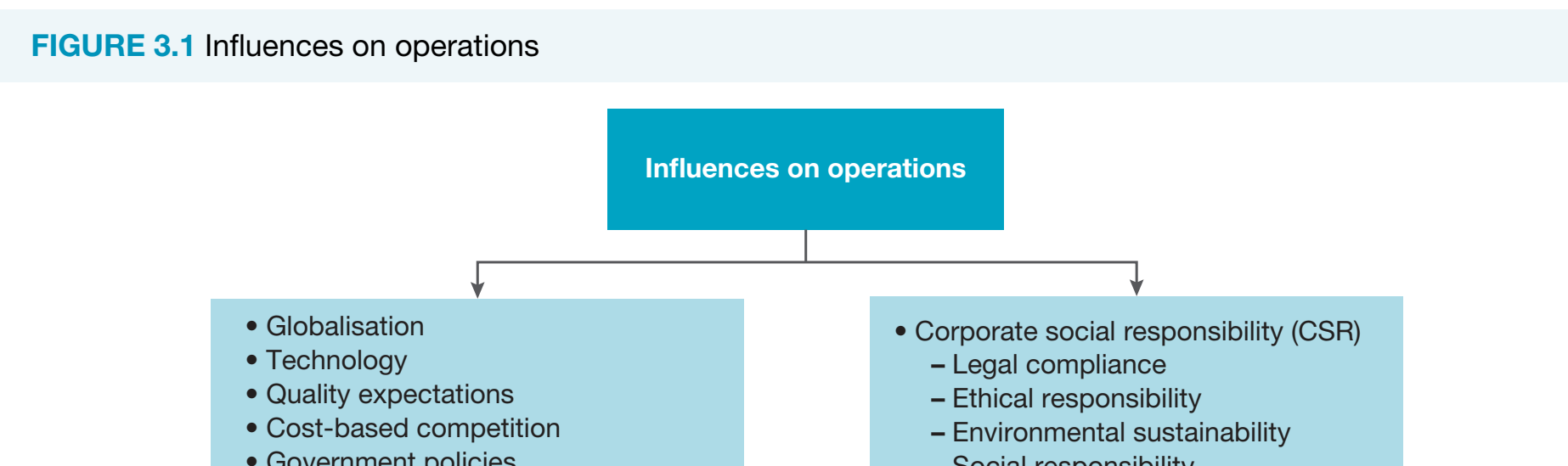

Finance and Operations

- Budget Allocation and Cost Control:

- Example: Toyota and Amazon demonstrate precision in budgeting to enhance operational efficacy.

Finance and Marketing

- Case Study: PepsiCo improves digital presence and market share through strategic financial planning.

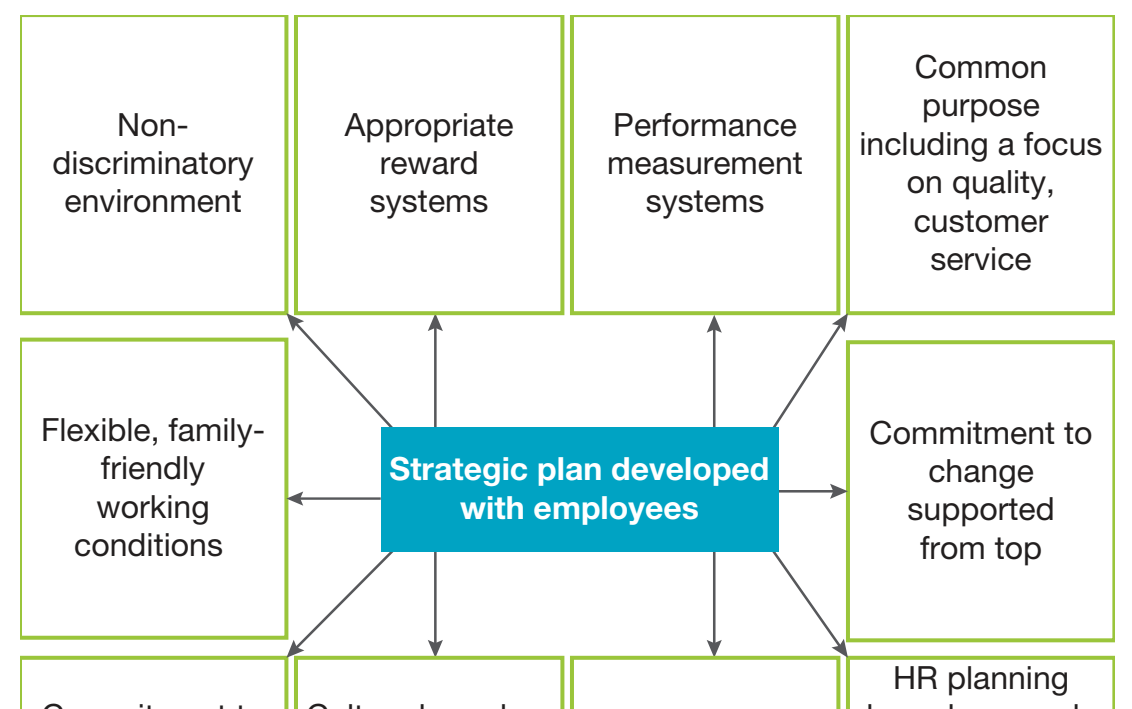

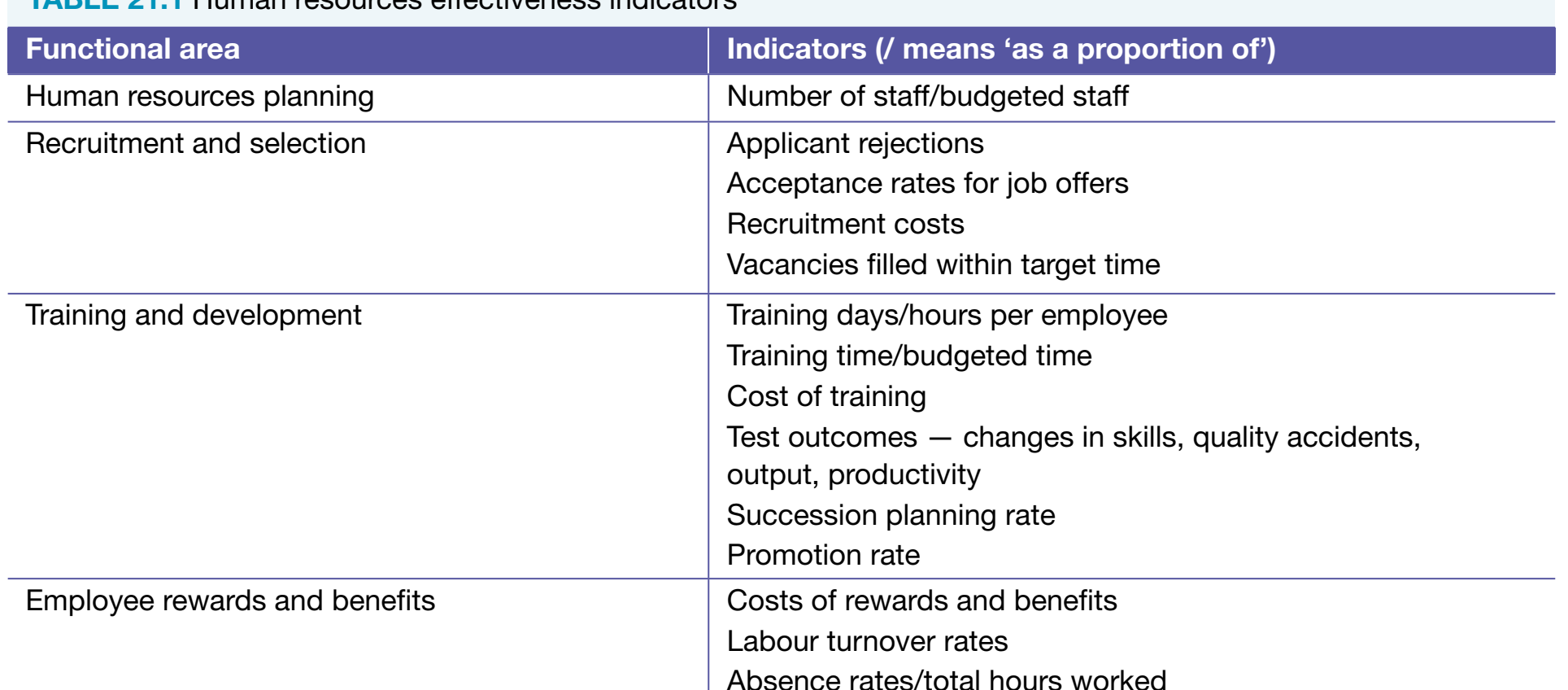

Finance and Human Resources

- Example of Google: Highlights the impact of financial decisions on HR indicators such as employee satisfaction.

Impact on HR: Financial management influences the quality of the workforce.

Finance and IT

- Investment Insights: Apple's R&D investments illustrate financial influence on innovation initiatives.

Challenges and Synergies

- Overcoming Barriers: Employ cross-training and collaboration tools to minimise silos.

Conclusion on Strategic Alignment

- Sustainability and Adaptability: Effective financial management aligns resources for long-term prosperity.

- Takeaways: Achieve success through proficient financial management, integration of technological advances, and adherence to sustainable practices.

500K+ Students Use These Powerful Tools to Master Financial Management Interdependence For their SSCE Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

90 flashcards

Flashcards on Financial Management Interdependence

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards14 quizzes

Quizzes on Financial Management Interdependence

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes22 questions

Exam questions on Financial Management Interdependence

Boost your confidence with real exam questions.

Try Business Studies Questions3 exams created

Exam Builder on Financial Management Interdependence

Create custom exams across topics for better practice!

Try Business Studies exam builder24 papers

Past Papers on Financial Management Interdependence

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Financial Management Interdependence you should explore

Discover More Revision Notes Related to Financial Management Interdependence to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Role of financial management

Financial Management Core Objectives

248+ studying

191KViews