Photo AI

Last Updated Sep 24, 2025

Foreign Exchange Rates Simplified Revision Notes for NSC Economics

Revision notes with simplified explanations to understand Foreign Exchange Rates quickly and effectively.

299+ students studying

Foreign Exchange Rates

Overview of the Foreign Exchange Market

- The Foreign Exchange (Forex) market is the largest and most fluid financial market worldwide.

- Daily trades amount to billions of USD, involving diverse global currencies.

- Key participants include:

- Central banks

- Commercial banks

- Investment firms

- Hedge funds

- Retail traders

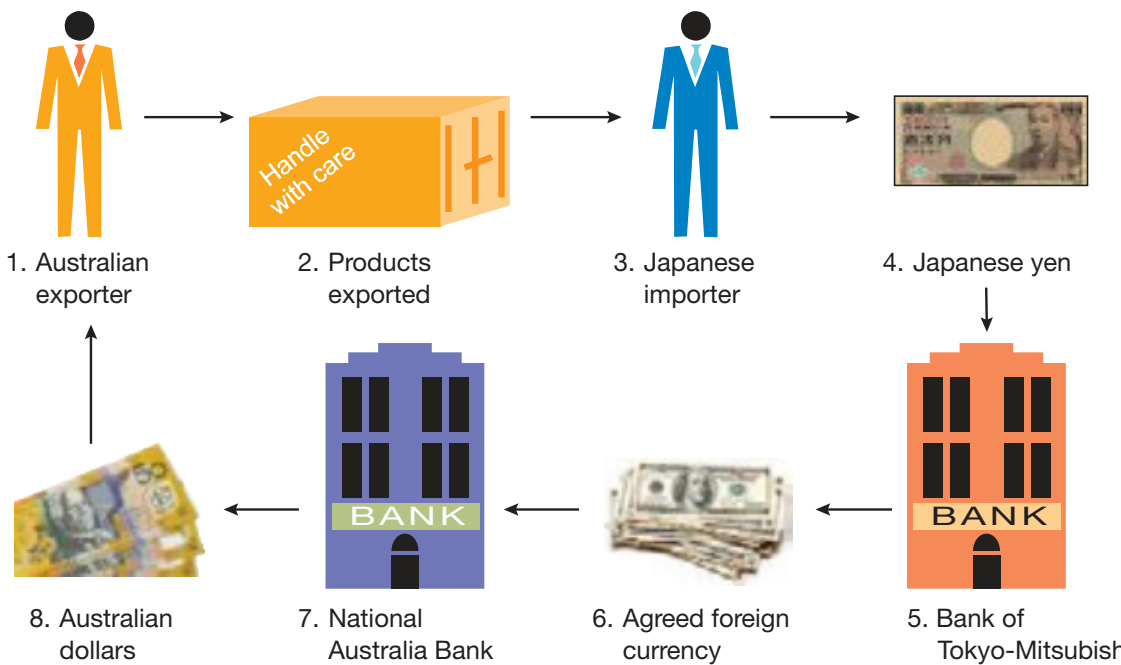

Diagram Explanation:

- Illustrates interactions among major players in currency exchange.

- Exhibits the influence of banks on currency flow.

Primary Functions of the Forex Market

- Currency Conversion: Fundamental for international trade and business operations.

- Example: A company converts profits in USD to EUR to support its European activities.

- Speculation influences exchange rates based on traders' actions.

- Example: A trader acquires USD anticipating its value will rise against EUR.

- Hedging: Mitigates risks from currency volatility.

- Example: A multinational corporation locks in a currency rate to protect against exchange rate fluctuations.

Currency Conversion: Crucial for global transactions by facilitating currency exchanges.

Definition of Key Terms

- Currency Pair: A combination of two currencies being traded (e.g., EUR/USD).

- Exchange Rate: The value of one currency relative to another.

- Bid Price: The price buyers are willing to pay for a currency.

- Ask Price: The price sellers set to offer a currency.

- Spread: The difference between bid and ask prices, indicating market cost.

- Currency Pair: In trading, involves pairs like EUR/USD.

- Exchange Rate: Reflects currency conversion value.

- Bid Price: Price to buy.

- Ask Price: Price to sell.

- Spread: Shows market expense.

Role of Financial Institutions in Establishing Exchange Rates

- Banks and forex dealers are pivotal in rate establishment through their transactions.

- Forex dealers ensure market liquidity.

- Central Banks influence exchange rates through policy decisions.

- Example: Raising interest rates may attract investors, leading to currency appreciation.

Introduction to Mechanisms

Exchange rates are essential in international trade and finance, determining how currencies are exchanged when purchasing goods and services globally. The Forex market sets these rates, and understanding this process is essential for making informed economic and financial decisions.

Demand and Supply Mechanism

- Exchange Rate Basics: Determined by interactions of supply and demand in the Forex market.

- Demand: Arises from needs such as purchasing goods abroad or travelling.

- Supply: Results from exports or foreign investments, adding to the currency supply.

Law of One Price and Arbitrage Opportunities

-

Law of One Price: Ensures identical goods have the same price in different markets when adjusted for exchange rates.

infoNoteLaw of One Price: Consistency in pricing for identical goods internationally, considering exchange rates.

-

Arbitrage:

- Exploiting price discrepancies between markets.

- Example: Purchasing an item for £70 in one market and selling it for £77 in another, profiting from the difference of £7.

- Currency pairs like USD/EUR can be used to identify profit opportunities.

Factors Affecting Demand and Supply in Forex

- Inflation Rates:

- Inflation: A general increase in prices, leading to currency depreciation.

infoNoteInflation: Price rises that decrease currency value.

:::

-

Example: As prices rise, the currency's buying power is reduced, leading to depreciation.

-

Interest Rates:

- Interest rates represent borrowing costs.

- Impact: Higher rates can attract foreign investments, elevating demand for the currency.

- Interest Rate Parity Theory: Links interest rate differences to expected currency changes.

Interplay Between Demand and Supply Factors

-

Demand-Side Factors:

- Importing Goods and Services: Increases demand for foreign currency, influencing currency demand.

- Tourism: Currency conversion by tourists affects demand.

infoNoteTourism's Economic Impact: Tourist currency exchange can significantly boost demand, affecting economies reliant on tourism.

-

Supply-Side Factors:

- Exporting Goods and Services: Increases foreign currency supply.

chatImportantExport and Investment Impact: Major sources of foreign currency inflow, offering stability to local economies.

Fixed Exchange Rate Systems

Fixed Exchange Rate System: This approach anchors a country's currency to a fixed value relative to another major currency.

Fixed Exchange Rate System: Provides a stable currency value linked to a strong, stable currency like the US dollar.

- Historical Example:

- Bretton Woods System: Developed post-World War II, fixing currencies to the US dollar (backed by gold) to ensure stable international exchange rates. Lasted until 1971.

Bretton Woods: A post-WWII system; sustained global currency stability until economic changes in 1971.

- Role of Central Banks:

- Central banks intervene in currency markets, using reserves to buy or sell currency to maintain fixed exchange rates.

- China's Currency Peg: A modern example of maintaining national currency stability through strategic intervention.

Balance of Payments (BoP) and Exchange Rates

Balance of Payments (BoP): An essential financial statement reflecting a nation's economic health through its international transactions.

-

Current Account: Encompasses trade in goods and services, income, and transfers.

-

Capital Account: Concerns international asset transfers with limited impact on exchange rates.

-

Financial Account: Covers investments, including direct and portfolio investments.

-

Implications of Trade Deficits and Surpluses:

- Deficits: Often lead to currency depreciation.

- Surpluses: Generally result in currency appreciation.

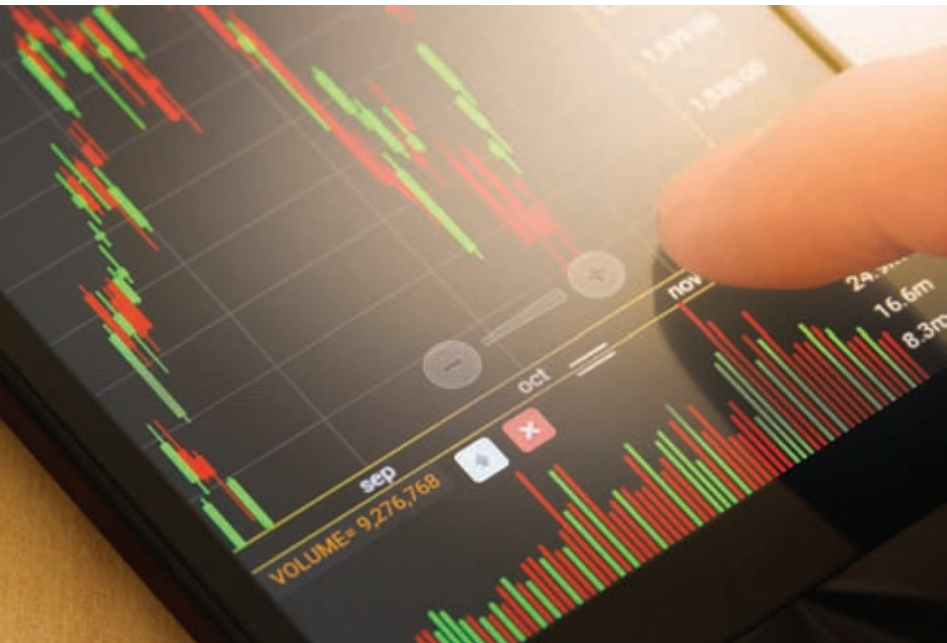

Graphical Interpretation of Exchange Rate Trends

- Graphs as Roadmaps:

- Like roadmaps for travellers, graphs assist traders in strategy development by simplifying complex data into visual interpretations.

Introduction to Forex Strategies

Forex Trading Strategy: A technique used by traders to determine whether to buy or sell currency pairs.

Basic Forex Trading Strategies

- 'Buy Low, Sell High' Strategy: Involves purchasing currencies at a low price and selling at a high price to secure profits.

- Scalping Strategy: A high-frequency trading strategy aiming for small profits through numerous rapid trades.

Analytical Approaches in Forex

- Technical Analysis: Uses historical market data to forecast future price movements.

- Fundamental Analysis: Evaluates currency value through economic indicators.

By mastering these concepts, you are better prepared to navigate the Forex market and efficiently analyse foreign exchange rates.

500K+ Students Use These Powerful Tools to Master Foreign Exchange Rates For their NSC Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

200 flashcards

Flashcards on Foreign Exchange Rates

Revise key concepts with interactive flashcards.

Try Economics Flashcards25 quizzes

Quizzes on Foreign Exchange Rates

Test your knowledge with fun and engaging quizzes.

Try Economics Quizzes11 questions

Exam questions on Foreign Exchange Rates

Boost your confidence with real exam questions.

Try Economics Questions8 exams created

Exam Builder on Foreign Exchange Rates

Create custom exams across topics for better practice!

Try Economics exam builder71 papers

Past Papers on Foreign Exchange Rates

Practice past papers to reinforce exam experience.

Try Economics Past PapersOther Revision Notes related to Foreign Exchange Rates you should explore

Discover More Revision Notes Related to Foreign Exchange Rates to Deepen Your Understanding and Improve Your Mastery