Photo AI

Last Updated Sep 24, 2025

Financial Institutions Overview Simplified Revision Notes for SSCE HSC Business Studies

Revision notes with simplified explanations to understand Financial Institutions Overview quickly and effectively.

401+ students studying

Financial Institutions Overview

Introduction to Financial Institutions

Financial institutions serve as the essential components that drive the economy forward. They efficiently manage, save, and borrow money, thus playing a crucial role in economic development.

Financial Institutions: Organisations that offer financial services and facilitate financial transactions. They have a significant impact on business financial decisions by managing, saving, and borrowing money efficiently.

Variety of Financial Institutions

Let us examine the various types of financial institutions and their roles:

-

Commercial Banks: Primarily involved in accepting deposits and providing loans. For instance, Lloyds Bank offers services such as savings accounts and personal loans. They act as secure places for your money and provide loans when needed.

-

Investment Banks: Specialise in advisory services and assist companies in raising capital, as exemplified by Goldman Sachs.

-

Finance Companies: Offer loans and leasing services to individuals and businesses, thereby supporting economic activity and growth.

-

Superannuation Funds: Manage funds for retirement income by investing contributions to ensure future financial security.

-

Life Insurance Companies: Provide risk management and financial security through life insurance policies, ensuring family financial stability in the event of unexpected life circumstances.

-

Unit Trusts: Allow for pooled investments, facilitating individuals in diversifying their asset holdings.

-

Australian Securities Exchange (ASX): Provides market services enabling the trading and investment of securities across Australia.

Roles and Functions of Financial Institutions

These institutions engage in financial intermediation, a vital activity that channels funds from savers to borrowers. Essentially, they facilitate the movement of money from savers to those who require it for growth, thereby supporting the efficient operation of businesses.

Regulation

Regulatory frameworks are essential for maintaining system stability and protecting consumers. They greatly influence operations and decision-making, such as choosing a bank or comprehending insurance policies.

Understanding regulations is crucial for safeguarding your financial decisions and the wider economy. For example, selecting a bank is made safer by regulations ensuring the security of your deposits.

Technological Influence

-

Fintech—the application of technology to enhance financial services—improves efficiency and accessibility within financial institutions, making services faster and easier to use.

-

Challenges include maintaining cybersecurity and rapidly adapting to ever-evolving technology landscapes.

Interconnections

Financial institutions are interconnected and collaborate to foster economic growth. They function like interlocking pieces of a puzzle, assisting businesses in strategising their expansion.

Collaboration in Financial Institutions: These entities cooperate to support business strategies and economic growth, ensuring a well-functioning financial ecosystem.

Commercial Banks

1. Definition and Primary Functions of Commercial Banks

- Commercial Banks: Operate principally by taking deposits and extending loans.

- Definition in Context: Institutions offering various financial services primarily through accepting deposits and offering loans.

infoNoteCommercial Banks: Institutions providing various financial services by accepting deposits and extending loans.

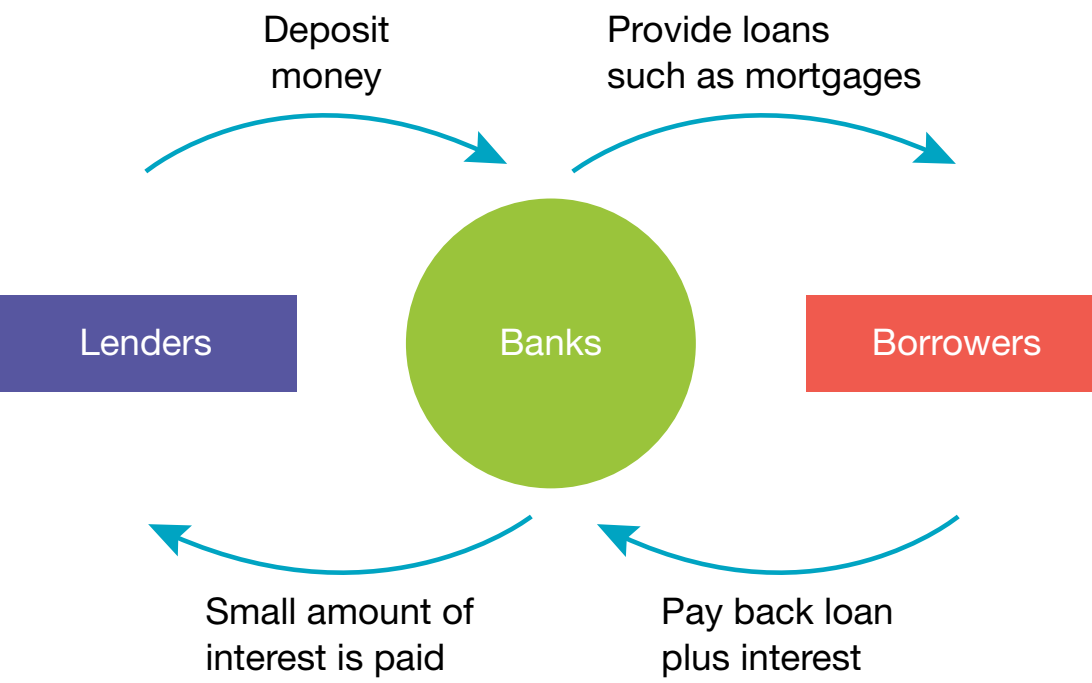

2. Role as Financial Intermediaries

- Intermediary Functions:

- Serve as a conduit between savers and borrowers, enabling efficient capital flow.

- Promote economic growth by pooling resources for loan provision.

Example of Resource Pooling

Imagine 100 individuals deposit £1000 each into a bank. The bank aggregates these deposits and extends a loan of £50,000 to a local business, thereby fostering its growth and aiding the economy. This enhances economic activity.

3. Impact on Business Financial Management

- Loans and Credit Facilities:

- Essential for business operations and growth strategies.

4. Distinction from Investment Banks

- Clientele and Revenue Models:

- Primarily focus on retail clients and small-to-medium businesses.

5. Risk Management and Regulatory Influences

-

Risk Management:

- Protect against credit and operational risks through provisioning and capital adequacy strategies.

infoNoteBasel III Regulations: Increase capital reserves to ensure banks can endure financial stress.

-

Regulatory Framework:

- Discuss Basel III and its impact on banking practices.

Overview of Investment Banks

Investment Banks are specialised entities focused on serving large corporations and affluent individuals rather than general consumers.

-

Underwriting: Assuming financial risks for a company's projects.

-

Mergers and Acquisitions (M&A): Facilitating company mergers or acquisitions for expansion purposes.

-

Financial Advising: Offering guidance in financial planning.

Role in Financial Solutions

Investment banks provide tailored financial solutions to meet the specific needs and challenges of businesses.

Investment and Loan Capabilities

Accumulated Premiums

Accumulated Premiums: Utilised for generating investment returns, crucial for financial operations.

- Investments are directed into stocks or bonds, enhancing the overall capital base.

Financial Intermediation

- Companies offer loans to businesses using premiums as a capital foundation.

Overview of the ASX

The Australian Securities Exchange (ASX) plays a vital role in Australia's financial structure.

- Facilitates Trading: Provides a platform for the orderly buying and selling of shares.

- Ensures Integrity: Enforces fairness and transparency in market operations.

Role of the ASX as a Primary and Secondary Market

- Primary Market: Platform where companies generate initial capital.

- Secondary Market: Facilitates investor trading of existing securities.

Primary vs Secondary Market: The primary market involves the issuance of new securities for raising capital, while the secondary market pertains to the trading of these issued securities among investors.

Conclusion

In conclusion, financial institutions are indispensable in supporting economic development and ensuring stable financial decisions for businesses.

500K+ Students Use These Powerful Tools to Master Financial Institutions Overview For their SSCE Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

160 flashcards

Flashcards on Financial Institutions Overview

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards20 quizzes

Quizzes on Financial Institutions Overview

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes53 questions

Exam questions on Financial Institutions Overview

Boost your confidence with real exam questions.

Try Business Studies Questions4 exams created

Exam Builder on Financial Institutions Overview

Create custom exams across topics for better practice!

Try Business Studies exam builder24 papers

Past Papers on Financial Institutions Overview

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Financial Institutions Overview you should explore

Discover More Revision Notes Related to Financial Institutions Overview to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Influences on financial management

Government Influence on Finance

317+ studying

198KViews96%

114 rated

Influences on financial management

Global Market Influences

423+ studying

189KViews