Photo AI

Last Updated Sep 24, 2025

Government Influence on Finance Simplified Revision Notes for SSCE HSC Business Studies

Revision notes with simplified explanations to understand Government Influence on Finance quickly and effectively.

275+ students studying

Government Influence on Finance

Introduction

- Government Influence: Government impacts financial management via regulatory and taxation measures.

- Significance for Businesses: Understanding these influences is essential for businesses to ensure compliance, manage risk, and formulate effective strategies.

- Example: Regulatory measures promote long-term sustainability by enforcing ethical business practices.

Key Areas of Influence

- ASIC: Australian Securities and Investments Commission

- Company Taxation

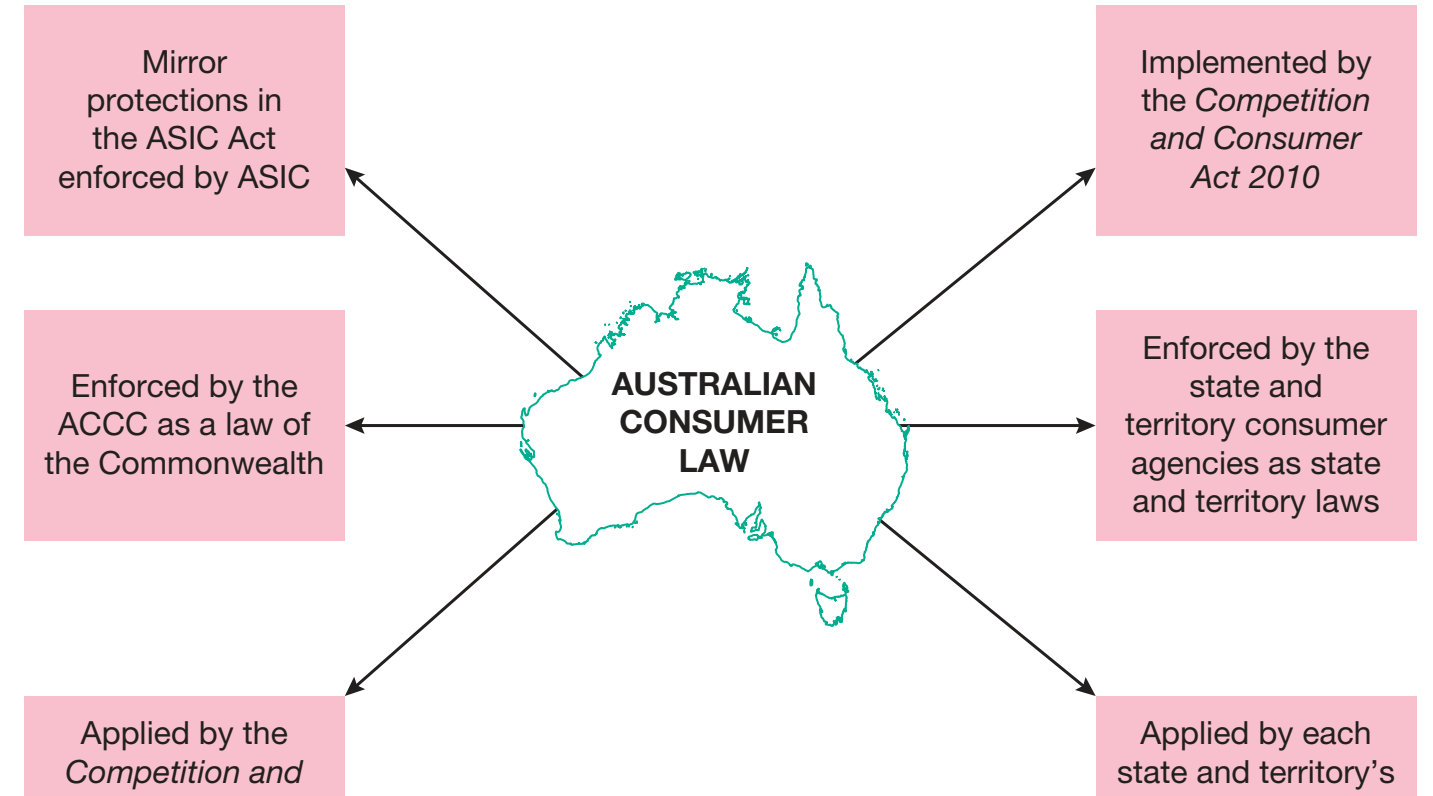

Diagram Introduction

The diagram below illustrates government influence over financial operations, focusing on regulatory and taxation measures:

The Role of Regulatory Compliance

-

Impact on Business: Compliance with regulations is crucial for maintaining a positive reputation and operational success. Non-compliance can lead to penalties such as fines or business restrictions.

-

Examples of Regulations:

- Securities laws – protect investors and ensure fair trading.

- Financial reporting standards – mandate accurate information disclosure.

- Environmental regulations – ensure sustainable and responsible environmental practices.

Australian Securities and Investments Commission (ASIC)

Introduction to ASIC

- ASIC: The Australian Securities and Investments Commission is an independent government body established in 1991 to regulate financial markets in Australia.

Purpose and Regulatory Roles of ASIC

-

Primary Roles:

- Enforce laws to protect consumers, investors, and creditors.

- Ensure market fairness by promoting transparency and ethical practices.

- Align Australian economic practices with global standards.

-

Regulatory Roles:

- Market Integrity: Ensures efficient and honest market operations.

- Corporate Compliance: Verifies adherence to legal and ethical standards.

- Public Accountability: Holds corporations accountable to their stakeholders.

- Consumer Protection: Safeguards consumer interests and rights.

Enforcement Powers

-

Authority:

- Investigate financial misconduct and infractions.

- Prosecute violations and impose penalties.

- Example: In 2022, Westpac was penalised by ASIC for inadequate risk management practices, resulting in fines and operational changes.

-

Impact: These enforcement actions help restore consumer trust and prompt corporate behavioural adjustments.

Influence on Financial Management Practices

- Corporate Engagement:

- Transparency in Reporting: Encourages detailed and honest financial disclosures.

- Investor Confidence: Bolsters trust by ensuring strict adherence to regulations.

Responsibilities of ASIC

- Regulatory Oversight: Ensures fair market practices. Licensing financial advisors prevents fraud and ensures ethical operations.

- Consumer Protection: Protects consumers by taking action against deceptive practices.

- Example: A major bank fined for misleading rate disclosures.

- Investor Confidence: Maintains trustworthiness in financial markets by enforcing regulations that support investor confidence.

Overview of Company Taxation

Introduction to Company Taxation

- Company Taxation: The process whereby the government collects a portion of a company's earnings, vital for funding public services and infrastructure.

- Influence on Financial Management:

- Affects financial health, strategic planning, and budgeting.

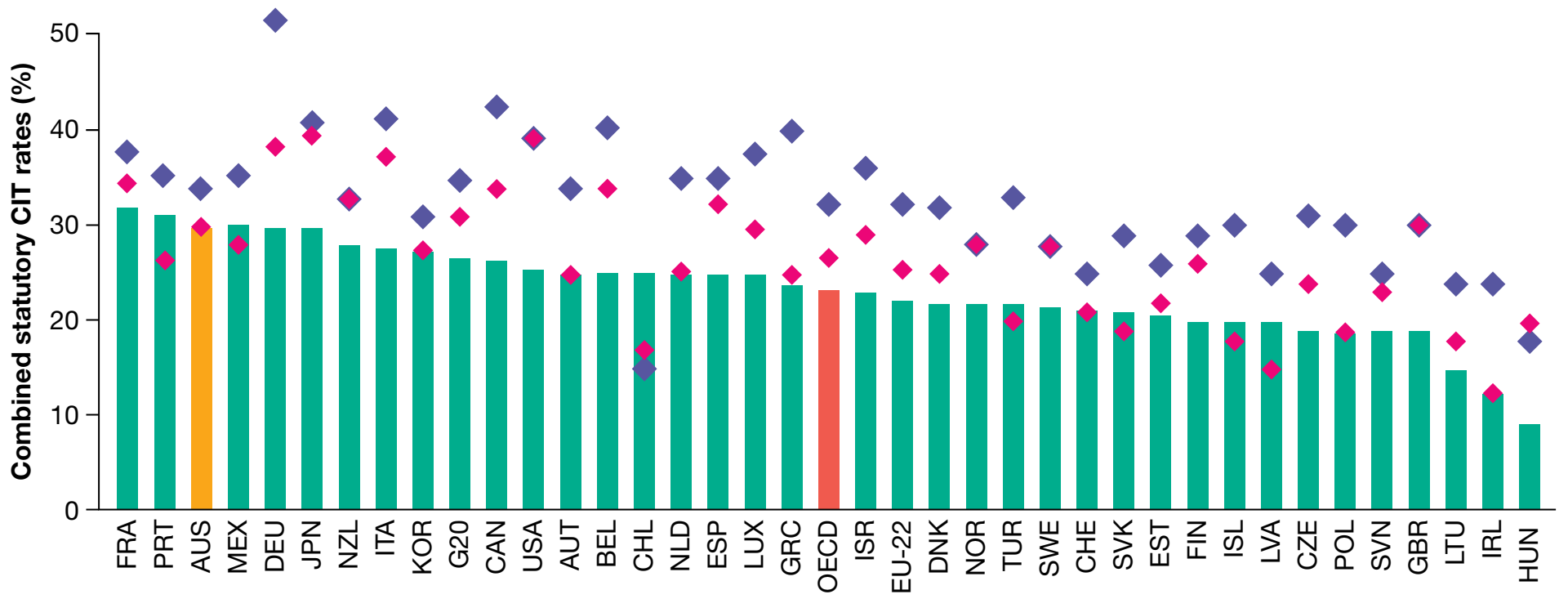

Current Corporate Tax Rates

- Corporate Tax Rate in Australia:

- Companies with a turnover below AUD $50 million: 25%

- Larger companies: 30%

Effects of Company Taxation

- Impact on Financial Planning:

- Influences cash flow, profit allocation, and decisions on dividends.

Worked Example:

- Determine Taxable Income: Total Revenue - Allowable Deductions

- Example: £500,000 revenue - £100,000 deductions = £400,000 taxable income

- Calculate Tax Payable: Taxable Income × Applicable Tax Rate

- Example: £400,000 × 30% = £120,000 tax payable

Influence of Economic Policies

Importance of Tax Planning Strategies

- Tax Liabilities Management: Effective strategies help decrease liabilities and boost funding for growth.

- Maximising After-Tax Profits: Strategies such as using tax credits and accelerating deductions enhance profitability.

Challenges and Compliance

- Tax Compliance: Constant legal updates require adaptability.

- Example: Making necessary adjustments to corporate operations to comply with changing tax laws.

- Potential for Penalties: Businesses should establish auditing practices to mitigate risks of penalties.

Strategic Approaches

- Investing in Expertise: Employing experienced consultants reduces the risk of penalties.

- Automation: Utilising software automates compliance tasks, saving valuable time.

Leading experts in regulatory affairs emphasise the importance of continuously adapting to legislative changes to manage and mitigate financial risks effectively.

Case Studies

- Innovate Tech Scenario: Optimising R&D tax credits resulting in a 10% profit increase due to enhanced technological capabilities.

- Commonwealth Bank of Australia (CBA) Case: Non-compliance led to fines enforced by ASIC to uphold financial ethics.

Expert Opinion

Expert View: Quickly adapting to legislative changes is vital for effective financial risk management.

500K+ Students Use These Powerful Tools to Master Government Influence on Finance For their SSCE Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

160 flashcards

Flashcards on Government Influence on Finance

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards20 quizzes

Quizzes on Government Influence on Finance

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes53 questions

Exam questions on Government Influence on Finance

Boost your confidence with real exam questions.

Try Business Studies Questions4 exams created

Exam Builder on Government Influence on Finance

Create custom exams across topics for better practice!

Try Business Studies exam builder24 papers

Past Papers on Government Influence on Finance

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Government Influence on Finance you should explore

Discover More Revision Notes Related to Government Influence on Finance to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Influences on financial management

Financial Institutions Overview

345+ studying

181KViews96%

114 rated

Influences on financial management

Global Market Influences

209+ studying

189KViews