Photo AI

Last Updated Sep 24, 2025

Business Ownership Forms Simplified Revision Notes for NSC Business Studies

Revision notes with simplified explanations to understand Business Ownership Forms quickly and effectively.

212+ students studying

Business Ownership Forms

Introduction

Understanding the various forms of business ownership is crucial for making informed decisions regarding control, liability, and growth potential. This comprehension is essential for choosing the most appropriate structure for a business.

Key Considerations: A firm grasp of control, liability, and growth potential aligns strategic business objectives by matching the ownership structure to business goals and associated risks.

Overview of Business Ownership Forms

- Each business form has distinctive characteristics affecting control rights, financial responsibilities, operational roles, and growth potential.

- Selecting the appropriate form impacts a business's success and longevity by shaping its framework and strategy.

Definition of Business Ownership

- Business ownership: The rights and responsibilities associated with control, financial liability, and operational involvement.

Key Terms

- Sole Proprietor:

- Owned and managed by an individual.

- Example: A local bakery.

- Partnership:

- Co-ownership by two or more individuals.

- Example: A medical clinic operated by partners.

- Close Corporation:

- Small number of shareholders managing operations.

- Example: Family-run businesses.

- Non-Profit Company:

- Engages in activities focused on social good.

- Example: Charitable organisations.

- Profit Companies:

- Aim to maximise investor returns.

- Example: Multinational corporations.

- Co-operatives:

- Member-owned and operated for mutual benefits.

- Example: Credit unions.

- Sole Proprietor: Owned by an individual.

- Partnership: Co-owned by two or more individuals.

- Close Corporation: Limited shareholders with direct management involvement.

- Non-Profit Company: Operates for public benefit, not profit.

- Profit Companies: Focussed on shareholder profits.

- Co-operatives: Member-owned for mutual benefit.

Sole Proprietorship

Definition

- Sole Proprietorship: A business owned and operated by a single individual, characterised by simplicity and control.

Characteristics

- Autonomy in Decision-Making: Provides the owner with complete control.

- Management Simplicity: Fewer regulations facilitate management.

- Operational Flexibility: Allows quick adaptation by the owner.

Advantages

- Streamlined Decision-Making: Enables immediate decisions without external approval.

- Complete Control and Flexibility: Offers significant adaptability.

- Minimal Regulatory Burden: Reduces paperwork and lowers initial setup costs.

Disadvantages

- Unlimited Liability: Owner's personal assets are at risk.

- Dependence on Owner's Skills: Limits delegation and growth opportunities.

- Challenges with Scaling: Resource constraints may restrict expansion.

Partnerships in Business

Definition

- Partnership: A business relationship with shared ownership among partners.

Partnership: A business co-owned by two or more individuals with shared responsibilities.

Characteristics

- Shared Ownership: Partners contribute resources and expertise.

- Collaborative Decision-Making: Managed jointly.

- Partnership Agreement: Specifies roles and profit distribution.

Advantages

- Resource Pooling: Increases access to resources and capital.

- Diverse Skill Sets: Promotes innovation through varied expertise.

- Shared Responsibility: Distributes risks and workload.

Disadvantages

- Potential for Conflict: Requires effective communication to manage disagreements.

- Joint Liability: All partners share liability for debts.

- Complex Termination: Needs detailed exit strategies.

Exam Tips

- Apply conflict management strategies such as regular meetings.

- Establish clear partnership agreements to prevent conflicts.

Close Corporations

Close Corporation: A privately-held business with limited shareholders.

Characteristics

- Limited Liability: Protects shareholders' personal assets.

- Reduced Reporting Requirements: Simplifies business operations.

- Direct Involvement: Ensures shareholder engagement in decisions.

Advantages

- Efficient Management: Facilitates quick decision-making.

- Limited Liability: Safeguards personal assets.

- Operational Flexibility: Allows swift responses to changes.

Disadvantages

- Limited Growth Capacity: Restricts capital acquisition.

- Transfer Restrictions: Shares are not publicly tradable.

Non-Profit Company

Non-Profit Company: Focuses on public benefit rather than profit.

Characteristics

- Surplus Reinvestment: Supports mission-related activities.

- Tax Advantages: Offers exemptions and grant eligibility.

- Compliance to Legal Norms: Requires adherence to standards.

Advantages

- Tax Benefits: Allows greater focus on mission activities.

- Increased Public Trust: Builds credibility.

- Access to Philanthropic Support: Attracts donations and grants.

Disadvantages

- Capital Access Challenges: Difficulty in securing loans.

- Profit Limitations.

- Regulatory Complexity: Requires regular audits.

Overview of Profit Companies

Profit companies drive innovation, job creation, and foster economic growth.

Key Types of Profit Companies:

- Private Company (Pty Ltd): Privately owned, restricted share circulation.

- Personal Liability Company (PLC): Directors assume personal liability.

- Public Company (Ltd): Shares available on public markets.

- State-Owned Company (SOC): Governed and owned by the government.

Private Company: An entity with privately held shares, restricted share transferability.

Characteristics

- Limited Liability.

- Separate Legal Status.

Co-operatives

Introduction

- Co-operatives: Owned and operated by members, prioritising equality.

Co-operatives: A business model that emphasises member collaboration.

Characteristics

- Democratic Governance: One vote per member.

- Profit Sharing: Distributes surpluses among members.

Advantages

- Member Focused: Empowers and engages members.

- Reduced Liability Risk: Limited personal financial exposure.

Disadvantages

- Scalability Difficulties: Restricted external funding options.

- Slower Decision Processes.

Exam Tips

- Encourage robust communication and clear role definitions.

Exam Strategy: Understand differences in management and operational approaches.

Side-by-Side Comparison Table

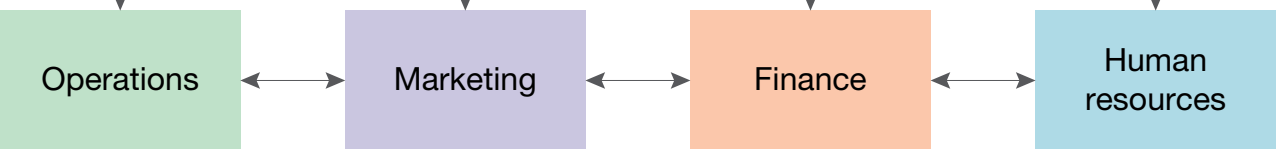

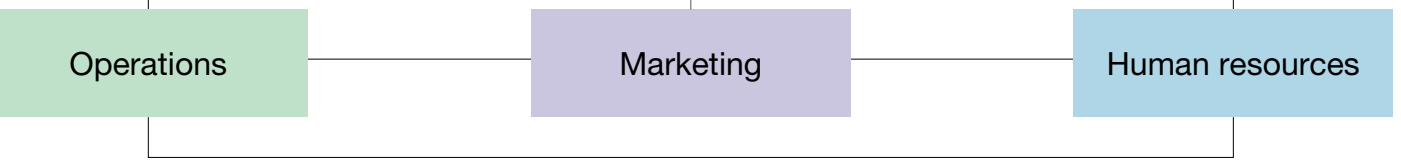

- Control and Decision-Making: Sole Proprietorships offer independence, while Partnerships and Co-operatives ensure shared input.

- Financial Liability: Corporations provide limited liability, thus reducing personal risk.

- Growth Potential and Capital Access: Public companies have easier access to capital.

- Regulatory Complexity: Sole proprietorships encounter fewer regulations.

- Operational Efficiency: Corporations are ideal for larger operations.

Case Studies

- Small Retail Store: A sole proprietorship faced limitations in growth due to capital constraints.

- Tech Start-up: Transitioning from partnership to corporation significantly increased investment.

Case studies: Demonstrate the evolution from simple ownership structures to complex formations for growth and risk mitigation.

500K+ Students Use These Powerful Tools to Master Business Ownership Forms For their NSC Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

50 flashcards

Flashcards on Business Ownership Forms

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards5 quizzes

Quizzes on Business Ownership Forms

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes15 questions

Exam questions on Business Ownership Forms

Boost your confidence with real exam questions.

Try Business Studies Questions6 exams created

Exam Builder on Business Ownership Forms

Create custom exams across topics for better practice!

Try Business Studies exam builder54 papers

Past Papers on Business Ownership Forms

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Business Ownership Forms you should explore

Discover More Revision Notes Related to Business Ownership Forms to Deepen Your Understanding and Improve Your Mastery

Load more notes