Photo AI

Last Updated Sep 24, 2025

Benefits Impact on Businesses Simplified Revision Notes for NSC Business Studies

Revision notes with simplified explanations to understand Benefits Impact on Businesses quickly and effectively.

303+ students studying

Benefits Impact on Businesses

Understanding Fringe Benefits

Fringe Benefits: Supplementary compensations, also known as non-wage compensations, provided to employees beyond their regular salaries. These benefits play a pivotal role in attracting and retaining employees while enhancing overall satisfaction.

Definition: Fringe benefits refer to supplementary compensations provided to employees beyond their regular salaries.

Importance of Fringe Benefits

- Competitive Advantage: Enables companies to attract and retain high-calibre employees.

- Boosts Satisfaction: Enhances employee morale.

- Tax Efficiency: Provides tax advantages.

Types of Fringe Benefits

Major Categories

-

Monetary Benefits

- Includes pension plans, bonuses, and profit-sharing.

- Tax Advantages: Offers a reduction in taxable income.

-

Healthcare Benefits

- Encompasses medical, dental, vision, and life insurance.

- Many of these are exempt from taxes.

-

Transport

- Provision of company cars, travel compensations.

- Aids in reducing personal travel expenses.

-

Work-Life Balance

- Involves flexible working hours, remote working options, and wellness programmes.

- Crucial in today's work environment.

-

Additional Perks

- Includes gym memberships, educational assistance, and stock options.

- Popular among tech firms such as Google.

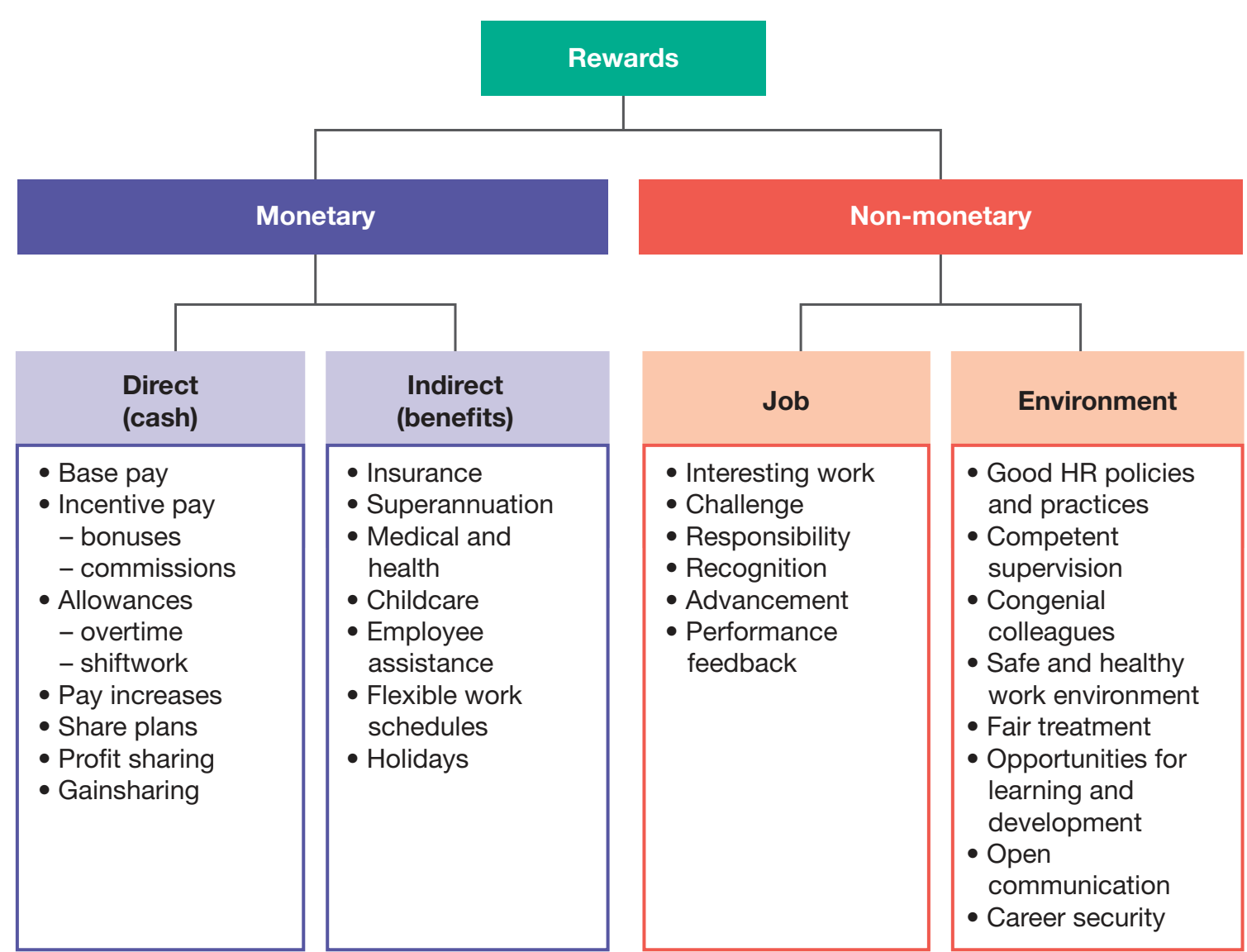

Visualising Fringe Benefits

The diagram below groups various categories of fringe benefits with examples, illustrating how each benefit addresses different employee needs:

Detailed Comparison Table

| Category | Examples | Typical Inclusions | Tax Implications | Company Examples |

|---|---|---|---|---|

| Monetary Benefits | Pension plans, Bonuses | Retirement savings | Reduces taxable income | General Electric |

| Healthcare Benefits | Medical insurance, Dental care | Coverage for medical costs | Often tax-free | Johnson & Johnson |

| Transport | Company cars, Travel compensation | Travel costs | Vary by country | BMW |

| Work-life Balance | Flexible hours, Remote work | Improved work conditions | Not directly taxable | IBM |

| Additional Perks | Gym memberships, Stock options | Personal development | Subject to taxes |

Key Insights from Student Conversations

- Target Demographic Preferences:

- Millennials prioritise flexibility and the option for remote work.

- Older employees favour pension plans.

Hypothetical Scenarios

- Consider choosing between a job offering childcare services and one with higher bonuses.

- Reflect on the effects on immediate needs versus long-term career goals.

Attract and Retain Talented Employees

Fringe Benefits:

Fringe benefits are ancillary benefits provided alongside regular salary, offering a competitive advantage in hiring and retaining employees.

- Attracts Top Talent: Companies offering fringe benefits draw high-quality candidates.

- Enhances Recruitment: Comprehensive benefits improve recruitment efficacy.

- Increases Loyalty: Robust benefits can lead to employee loyalty.

- Statistics: A 20% increase in retention rates has been noted in such organisations.

Case Study: Google leverages fringe benefits like on-site wellness centres and flexible working policies to attract elite talent.

Improve Employee Morale and Productivity

Fringe benefits significantly enhance employee morale and productivity:

Productivity Enhancement

- Wellness Programmes: Enhance employees' physical health and well-being at the workplace.

- Scenario: Gym memberships contribute to increased employee happiness.

- Work Flexibility: Enables employees to balance professional and personal obligations.

- Scenario: Flexible working hours allow parents to attend school functions stress-free.

- Categories of Benefits:

- Mental Health: Incorporates counselling services.

- Work Flexibility: Options such as telecommuting enhance satisfaction.

Feedback: "Wellness initiatives in our company have led to increased productivity and employee contentment."

Tax Benefits

Tax-Deductible:

Such expenses lower taxable income. Often, benefits like pensions and medical aid are eligible for deductions.

- Key Elements:

- Pension Plans and Medical Aid often qualify as tax-deductible.

Scenario: A company effectively decreases its taxable income using tax-deductible benefits, thereby freeing up more resources for employee initiatives.

Cost to the Business

-

Financial Implications: Providing fringe benefits involves both direct expenses (e.g., company vehicles) and indirect costs (e.g., management resources), which can notably impact corporate finances.

-

Return on Investment (ROI): Assessing ROI on fringe benefits is complex due to varying employee needs and satisfaction levels.

ROI Calculation:

-

Formula:

-

Turnover Cost:

Example: If a company spends £50,000 on benefits and gains £60,000 by retaining talent, the ROI is:

- Statistics and Trends: Data illustrates a consistent increase in the cost of comprehensive benefits over the last decade. Research indicates an escalation from 25% to 35% of company budgets allocated to employee benefits.

Complexity in Administration

- Administrative Challenges: Managing benefits requires time, expertise, and resources. This involves monitoring benefit eligibility and adapting to technological advancements, posing challenges for companies that lack dedicated HR resources.

Efficient administration of benefits can lower overhead costs but demands significant resources. Streamlining these processes is essential.

- Compliance Issues: Adhering to various regulations can be complex. Non-compliance may result in severe fines, making a comprehensive understanding of legal requirements vital for any business.

Potential Employee Dissatisfaction

-

Mismatch with Expectations: Employees may experience dissatisfaction if benefits do not align with their needs. Feedback from 'sam_hr' and 'oliver_finance' often highlights inadequacies, such as limited health coverage.

-

Case Scenarios: Common dissatisfaction scenarios encompass:

| Scenario | Cause |

|---|---|

| Limited health coverage | High out-of-pocket costs |

| Inflexible plans | Lack of customisation options |

Solutions and Examples

-

Strategic HR Solutions: Adopting modern digital platforms can simplify benefits administration. These platforms centralise various tasks, reducing resource demands.

-

Outsourcing: Engaging third-party expertise can alleviate administrative burdens. However, it might result in reduced direct control over processes.

-

Example Strategies: A case study from TechCorp showcases successful implementation. They managed a 30% decrease in administration costs and saw a 15% improvement in employee satisfaction due to digital management tools.

Student Feedback Integration

-

Feedback Highlights: Student feedback, noted by 'sam_hr' and 'oliver_finance', underscores a demand for more customisable benefits.

-

Potential Solutions: Offering tailored benefits enhances satisfaction by better aligning with employee preferences, particularly relevant in exams focused on HR strategies to boost employee engagement.

500K+ Students Use These Powerful Tools to Master Benefits Impact on Businesses For their NSC Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

20 flashcards

Flashcards on Benefits Impact on Businesses

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards5 quizzes

Quizzes on Benefits Impact on Businesses

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes4 questions

Exam questions on Benefits Impact on Businesses

Boost your confidence with real exam questions.

Try Business Studies Questions27 exams created

Exam Builder on Benefits Impact on Businesses

Create custom exams across topics for better practice!

Try Business Studies exam builder54 papers

Past Papers on Benefits Impact on Businesses

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Benefits Impact on Businesses you should explore

Discover More Revision Notes Related to Benefits Impact on Businesses to Deepen Your Understanding and Improve Your Mastery

Load more notes