Photo AI

Last Updated Sep 24, 2025

Workplace Fund Misuse Simplified Revision Notes for NSC Business Studies

Revision notes with simplified explanations to understand Workplace Fund Misuse quickly and effectively.

359+ students studying

Workplace Fund Misuse

Introduction

- Unauthorised use of funds and resources: This practice undermines a company's integrity and performance significantly.

- Company losses attributable to workplace fraud are approximately £3.7 trillion annually (Association of Certified Fraud Examiners).

- Timely detection is vital in preventing significant financial detriment and protecting the company's reputation.

Ethics: Essential for promoting fairness, trust, and a supportive organisational culture.

Types of Unauthorised Use

-

Theft:

- Definition: Unlawfully taking company assets without consent.

- Example Scenario: Employees removing office supplies for personal use.

-

infoNote

Although individual acts may seem minor, accumulated small thefts can cause substantial financial losses.

-

Embezzlement:

- Definition: Illegitimately redirecting funds or assets one has been entrusted with.

- Example Scenario: A financial officer rerouting company funds into a personal account.

- Comprehensive Diagram:

-

Misuse of Company Property:

- Definition: Employing company-owned assets for unauthorised activities.

- Example Scenario: Utilising work computers for operating personal businesses.

-

Personal Use of Company Vehicles:

- Definition: The unauthorised utilisation of company vehicles for personal travel.

Ethical Considerations

Unauthorised use undermines the following ethical principles:

- Honesty: Central to maintaining financial integrity.

- Integrity: Ensures actions align with moral standards, thereby enhancing the organisational reputation.

- Accountability: Encourages responsibility and trust across the workplace.

- Honesty: Fundamental for sustaining financial integrity.

- Integrity: Aligns actions with moral values, augmenting the company's reputation.

- Accountability: Cultivates a sense of responsibility and trust.

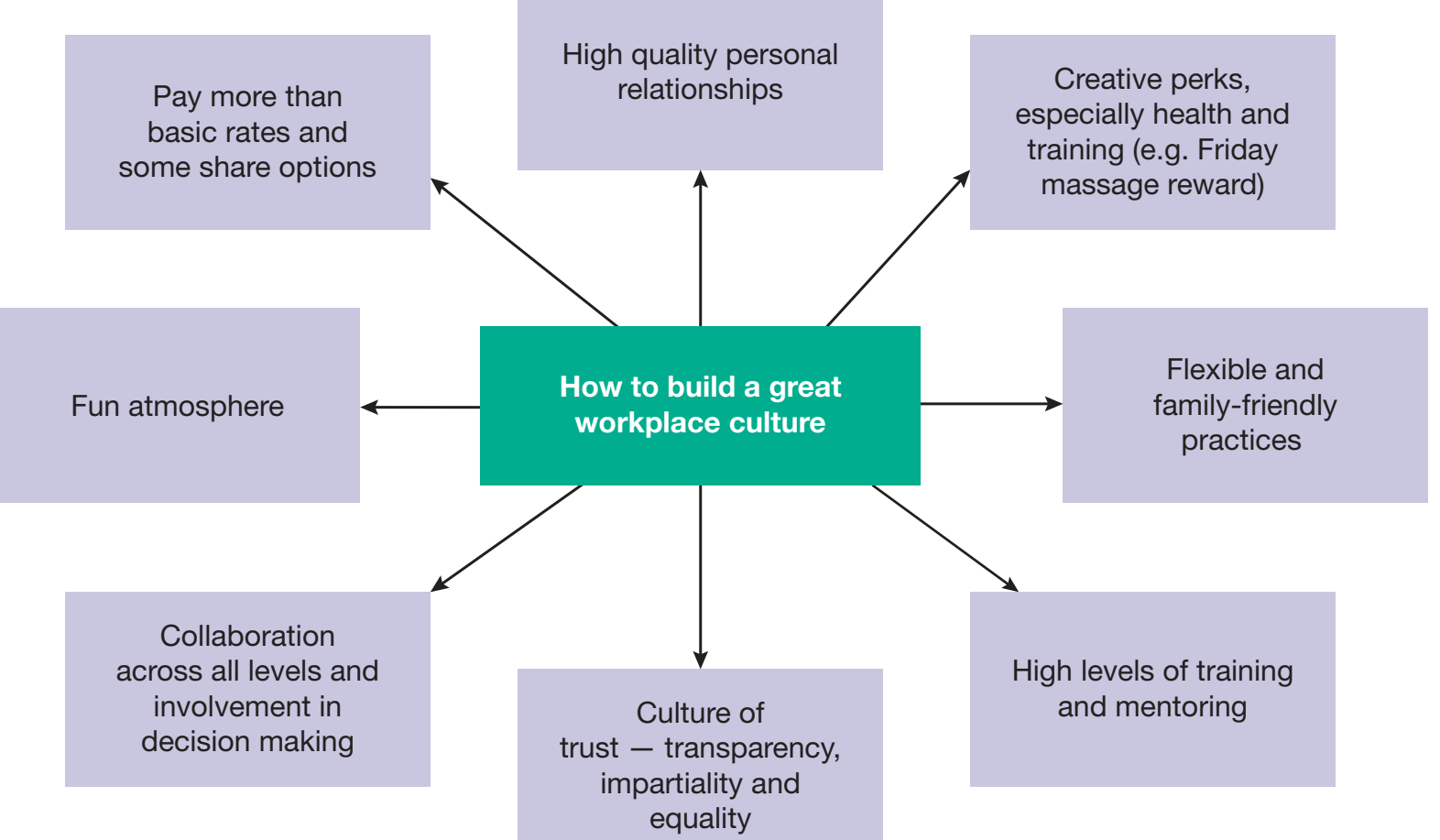

Impact on Workplace Culture

- Employee Trust: Unauthorised actions erode trust, which can lower morale.

- Leads to reduced collaboration.

- Enhances communication barriers.

- Charts detail the relationship between trust and workplace productivity over time.

Legal Ramifications

-

Criminal Charges: Result from violations of laws concerning the use of funds (potential imprisonment may follow).

- Data indicates that 60% of offenders are sentenced to jail time.

-

Civil Lawsuits: Aim at restitution and compensation.

- Initiates legal proceedings focusing on remuneration or damages.

| Aspect | Criminal Charges | Civil Lawsuits |

|---|---|---|

| Initiator | State or Government | Private Party |

| Consequences | Imprisonment or fines | Restitution or damages |

| Outcomes | Criminal record or sentence | Financial compensation |

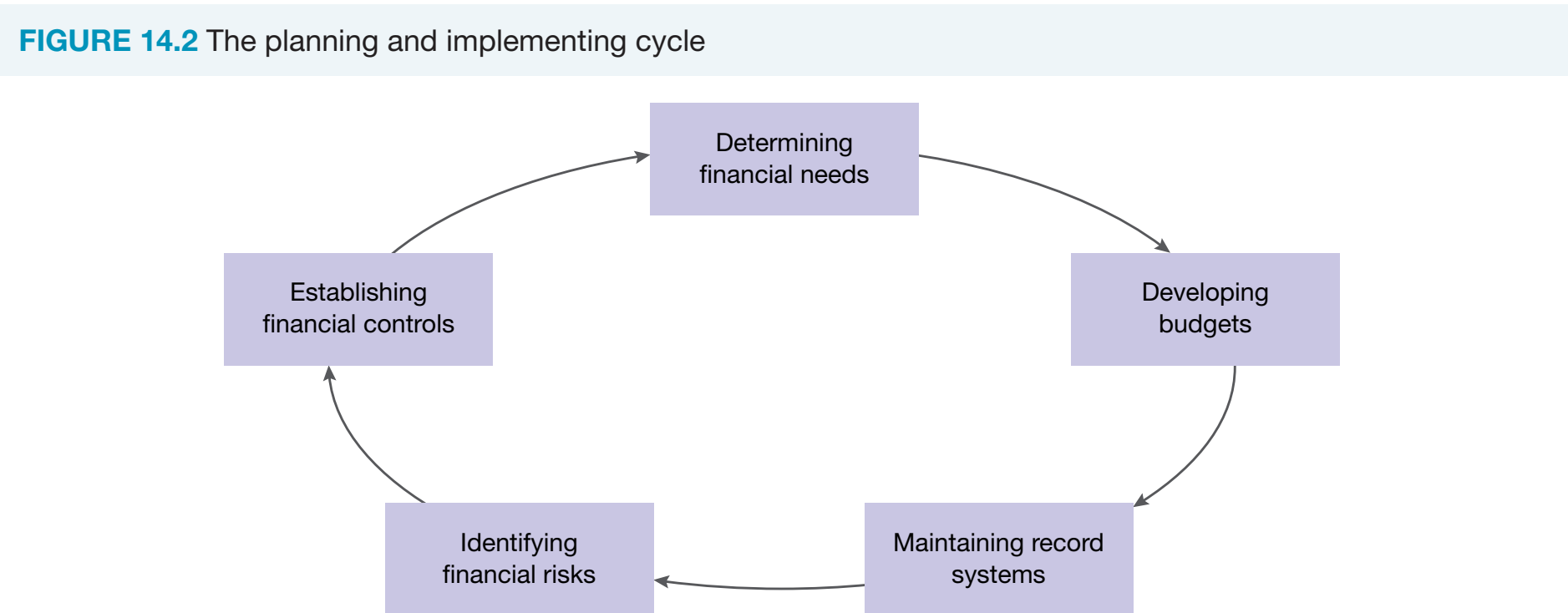

Internal Controls

-

Definition and Importance:

- Internal Controls: These are crucial for maintaining financial integrity and preventing misuse.

-

Types of Internal Controls:

- Segregation of Duties:

- Prevents fraud by ensuring no individual has complete control over any transaction.

- Authorisation Controls:

- Requires all transactions to be approved by authorised personnel.

- Requires all transactions to be approved by authorised personnel.

- Segregation of Duties:

Prevention and Success Strategies

- Regular Audits: Vital for the early identification of irregularities.

- Employee Training: Ongoing education on company policies and ethical standards.

- Whistleblower Policies: Provide secure mechanisms for reporting misconduct.

- Case Studies:

- Company A: Achieved a 50% reduction in fraud incidents by enhancing internal controls.

Strategies for Effective Communication

- Regular updates on policy changes:

- Outcome: Ensures compliance through continual messaging.

- Workshops and seminars:

- Outcome: Improves decision-making skills.

Fostering an Open Organisational Culture

- Benefits of an Open Culture:

- Increased employee morale

- Enhanced trust and cohesion among team members

- Action Steps: Implement explicit policies, conduct regular audits, and encourage an open culture for reporting.

- Cultivate a proactive approach in the workplace to mitigate ethical issues.

Management and Leadership

- Lead by example: Set a precedent for ethical behaviour.

- Reward ethical behaviour: Publicly acknowledge responsible decision-making.

Practice Question

- Example: Describe two types of internal controls and discuss their advantages.

- Solution:

- Segregation of Duties: By dividing responsibilities among different employees, no single person has control over all aspects of financial transactions. This reduces the risk of fraud as collusion would be required. Advantages include increased accountability and reduced error risk.

- Authorisation Controls: Requiring approval from designated personnel before completing transactions ensures oversight. Advantages include preventing unauthorised spending and creating a clear audit trail of decision-making.

- Solution:

500K+ Students Use These Powerful Tools to Master Workplace Fund Misuse For their NSC Exams.

Enhance your understanding with flashcards, quizzes, and exams—designed to help you grasp key concepts, reinforce learning, and master any topic with confidence!

220 flashcards

Flashcards on Workplace Fund Misuse

Revise key concepts with interactive flashcards.

Try Business Studies Flashcards30 quizzes

Quizzes on Workplace Fund Misuse

Test your knowledge with fun and engaging quizzes.

Try Business Studies Quizzes9 questions

Exam questions on Workplace Fund Misuse

Boost your confidence with real exam questions.

Try Business Studies Questions27 exams created

Exam Builder on Workplace Fund Misuse

Create custom exams across topics for better practice!

Try Business Studies exam builder54 papers

Past Papers on Workplace Fund Misuse

Practice past papers to reinforce exam experience.

Try Business Studies Past PapersOther Revision Notes related to Workplace Fund Misuse you should explore

Discover More Revision Notes Related to Workplace Fund Misuse to Deepen Your Understanding and Improve Your Mastery

96%

114 rated

Unethical Business Practices

Sexual Harassment in Business

446+ studying

181KViews